PSF: 22_12_2025

Esse texto é de autoria de Angie Setzer, consultora de Grãos da Marex US.

O Footnotes é postado todo sábado no portal Brz Report (plataforma da Agrinvest onde você encontra basis, trades, fluxo das commodities, preços do mercado físico, cobertura da China e muito mais).

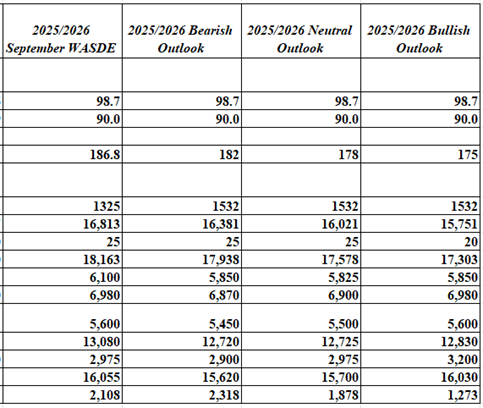

As promised last week, it is time to do a bit of a deep dive into the corn balance sheet. Like last week, I wanted to look at what we might face in the year ahead that could be bearish, neutral or supportive to price.

In addition to the corn outlooks, at the end I’ll present updated bean balance sheets now that the initial Trump/Xi meeting is behind us and we can at least feel comfortable knowing China bean demand out of the US will not be zero.

Corn

Like soybean harvest, corn harvest is entering its final stages across much of the United States, with some surprising results encountered along the way. Too much rain, too little rain, disease pressure and other issues were far more prevalent in this year’s harvest reports than last. Iowa and Illinois seemed to be hit the hardest with corn yields coming in below expectations. Anecdotal reports out of both states indicate open elevator space at the end of harvest, with some reporting inbound corn figures at their lowest in over a decade.

Not everywhere is worse than expected though, with reports out of Indiana surprisingly solid and elevator space across parts of the Dakotas filling up rapidly.

Mixed results and heavy disease pressure make a new record corn yield likely difficult to come by, with some suggesting yields could be well below a year ago. Adding to the confusion is a question over corn acres and how many of the added acres from the FSA data will make it into the commercial pipeline.

Like trying to pin down a production number, pinning down a figure on demand proves difficult as well. Many of us have been conditioned to believe that domestic and global corn demand is stagnant, something that couldn’t be further from the truth. Globally more corn is being fed and used for biofuels than ever before. When looking at the demand breakdown for the year ahead I broke things down by worse than currently expected by the USDA, in line with expectations and better.

One important point, I changed beginning stocks in my outlook to match the USDA’s September Quarterly Stocks.

Continue reading in the: Friday Footnotes: A Tale of Three Outlooks - Corn