PSF: 20_10_2025

Esse texto é de autoria de Angie Setzer, consultora de Grãos da Marex US.

O Footnotes é postado todo sábado no portal Brz Report (plataforma da Agrinvest onde você encontra basis, trades, fluxo das commodities, preços do mercado físico, cobertura da China e muito mais).

It has been over six weeks since our last look at an official supply and demand outlook from the USDA. In that time harvest rapidly progressed across much of the Corn Belt, with most farmers able to put the crop away within the next couple of weeks. While the absence of government data has left a bit of a void, causing some frustration amongst the trade, the rapid pace of harvest and subsequent cash moves can provide some insight into what is happening at ground level.

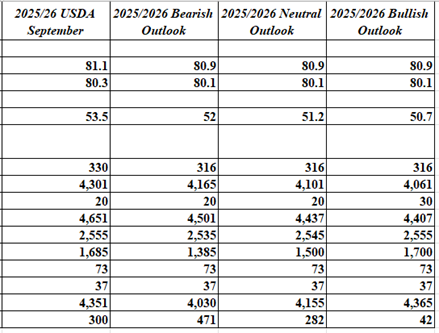

Over the next couple of weeks, I wanted to take some of what we’ve learned as harvest has rolled on and some of what we’re seeing from early season demand signals to create three possible outlooks for each crop. With these outlooks I will explain some of my thoughts behind the adjustments. This week we are going to focus on soybeans.

When looking at cash across the country, it is evident that the flow of soybeans into the pipeline was much smaller than expected. Basis has firmed significantly across the Corn Belt as harvest has progressed, with bids even firming in North Dakota, the supposed epicenter of storage and demand shortfalls.

While many insist this is because of greater than usual farmer holding, that cannot come close to causing the ripples in cash that we have seen this year. Of course, the significant cuts to bean acres and increase in corn acres has been a hot topic this year and could be behind some of what we are seeing.

Across the Corn Belt farmers cut soybean acres to the tune of 200,000 to 500,000 acres per state, resulting in anywhere from 10 to 30 million bushels of year over year production declines. This could possibly explain some of the “empty feelings” that are out there, however, this does not answer how numerous merchandisers have found themselves coming in well below expectations on inbound shipments, as acreage should have been considered when those estimates were made.

Taking all of this into account, it is very likely that final soybean yields will come in below the current USDA estimate, it’s just a matter of how far below. With a current carryout projection of just 295 million bushels on the back of a robust record yield there are many ways the year ahead of us could play out.

Continue reading in the: Friday Footnotes: A Tale of Three Outlooks - Soybeans