O presidente Trump ordenou uma série de medidas contra a Colômbia

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 15/01/2025 08:45

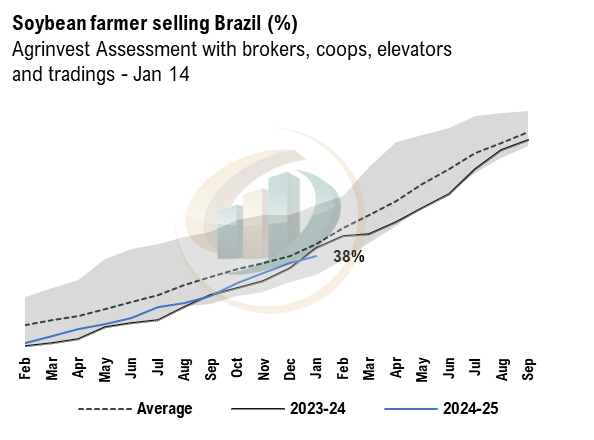

New lows for Soybean basis CFR China. Trades for Feb, Mar, April and June. Basis are $1 per bushel below November’s levels. The calculation for Arg UP River is close – smaller vessels from North Ports. Farmer selling in Brz close to 3 Mi tons in three days. No respite for Arg till Feb – too hot and dry. Dec CPI in Arg came at 2.7% MoM, in line with market expectations. Arg CB decided to keep the interest rate at 32% and reduced crawling peg over peso from 2% to 1% from Feb onwards – not good for FS. The SBM market in Arg is firmer for nearby shipments, and Brz is following the beans downward spiral. Crush margin in Brz is good and the industries coverage is advancing to May at North and March-April in the Center-South (coverage is at 28% of the 57-million program). Soybean meal sales in China decreased as expected. The daily average this week is at 127 thousand tons, 220 thousand below last week. Smeal basis in China are firmer for nearby and very low for JJAS delivery. The 5-day moving average of hog slaughter of large scale operations in China resumed the growth trend – 5-day moving average is at 160k, 5k above the last week.