PSF: 29_12_2025

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 20/12/2024 08:47

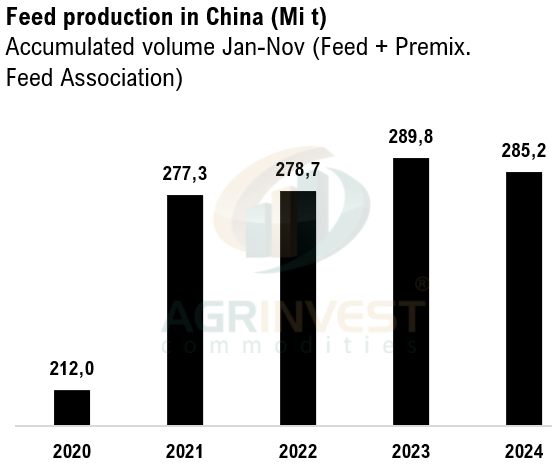

Another very volatile day for FX in Brazil. The Central Bank held two spot dollar auctions. They sold $3 billion, which wasn’t enough, so they added another $5 billion – the largest since 1999 for one single day. Today CB will hold another $7 billion auction. Including today, Brz CB sold $27 billion in reserves (the total reserves are at $366 billion – end of Oct). The crushers interest for new purchases in CFR for nearby shipments seems dead. More tradings are trying to sell Fob. Cheaper ocean freights for January – the carry of freight curve. China booked 02 cargoes for May out of USG. Rumors for Feb and March on Fob Santos and CFR. Trades reported in the North of Brazil for July, Itaqui corridor. Corn program 2024 is close to its end. The liquidity is concentrated in Aug-Sep. The origination cost has been cheap during this week, especially for Northern corridors – the logistics cost is the greatest concern. China’s coverage for Feb and March is more than 90%. This week a total of 25 cargoes were reported so far. Smeal sales in China are also slow - Smeal daily sales this week are at 760k tons (5 days), 34% smaller than last week. Smeal basis in Guangdong for JJAS window keeps diving (-90 RMB/t over DCE Sep). The feed production in China Jan-Nov totaled 285,2 Mi tons, 4,6 Mi tons below LY. Rumour of Chinese anti dumping tariff on Canadian canola will be announced next week. Rapeseed complex rally today in China.

Soybean Paper MKT – Dec 19

(daily variation)

Feb +30sh (-5) vs +20sh (unch)

Mch +1sh (+1) vs -7sh (-2)

Apr +1sk (+1) ?? vs -7sk (-2)

May +28sk (-2) vs +18sk (+3)

Jun +40sn (-5) vs +25sn (+5)

Jul ?? vs +35sn (+5)

Trades: Apr at -5sk (same as ystd) and May at +20sk

Cargo market (Fob Santos + options)

LH Feb +40sh (-20) vs +5sh

LH Apr +30sk vs +0sk