Áudio alerta sobre EUA

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 26/11/2024 08:13

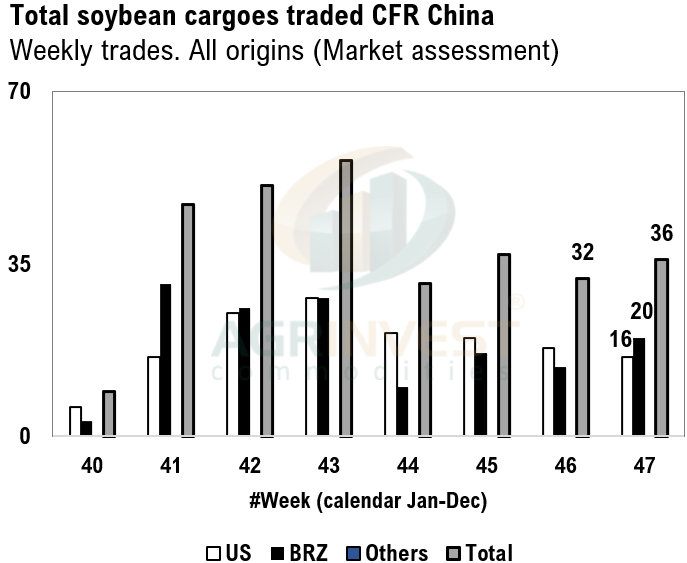

The week kicks off and soybean and corn farmer selling starts very slow again. The flat price dropped by 5 BRL per sack in many regions. The replacement cost is higher than LY and exporters are still trying to negotiate better conditions and more flexibility for TOP’s for 2025. Lack of rain in the last 10 days in parts of Paraná, MGDS and Paraguay. The difference this is year is temperature (close to normal). Models show good volumes of rain for all regions for the next 15 days. Russia will raise its sunflower oil export duty three-fold to 9,195.8 roubles ($88.42) per metric ton in December – Reuters. Soybean oil is climbing today, following the Trump’s tariffs on Canada, Mexico and China. Talks that Sino is asking for USG beans for Feb. Estimates of 35-40 soybean cargoes traded last week on CFR China – 15-16 from the US. Freights for nearby plunged, helping Brz (more cargoes reported for Dec). Commercial Crushers in China are talking about lower crush rate for Feb-Mar – Dec-Jan shipments. The EUDR amendment votes still remains in place, factoring doubts about the deadline – could support Smeal futures?

Soybean Paper MKT – Nov 25

(daily variation)

Feb +65sh (-10) vs +60sh (+5)

Mch +40sh (unch) vs +32sh (+12)

Apr +37sk (-3) vs +23sk (+3)

Apr-May +46sk (-2) vs +34sk (+4)

May +55sk (unch) vs +45sk (+5)

Jun +65sn (+7) vs +50sn (+2)

Jul +90sn (+10) vs +60sn (+2)

Trades: March at +38sh

Cargo Market (Santos/Tuba):

LH Feb25 +77sh (-3) vs ??

FH Mar25 +63sh (-2) vs ??

LH Mar25 +58sh (-2) vs ??