PSF: 15_12_2025

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 21/11/2024 08:33

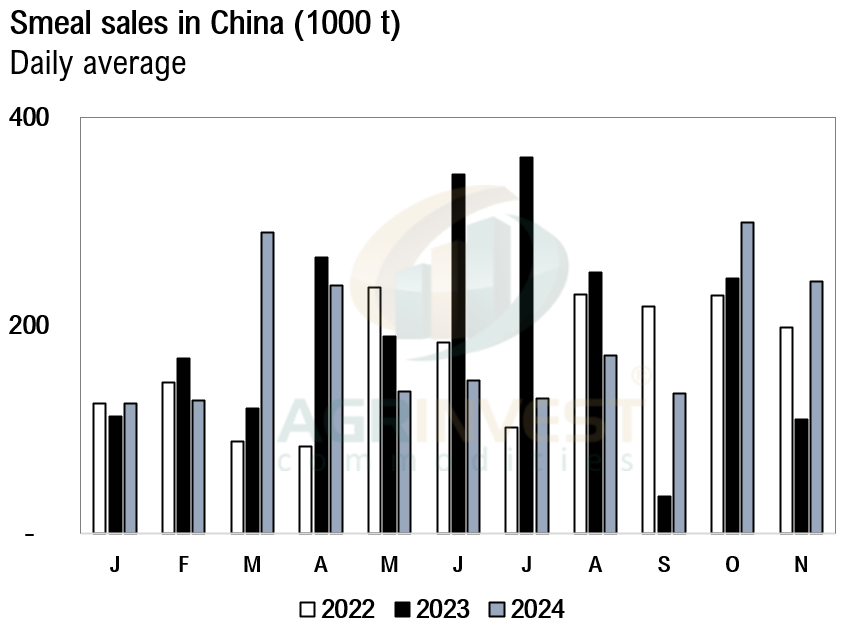

China is more active this week. Sino remains the only buyer out of the US. A few cargoes were booked during the night for Feb. This week I have counted 24 cargoes trade CFR, 9/10 out of the US. FOB levels and CFR keep falling, as does the flat price. Freights for Dec Santos-N.CH traded below $29/t, $6-7 lower compared to last month. Much smaller corn and soybean programs are the main reason for this. Lower freights for Jan could add further pressure over US programs. SK NOFI bought corn from Bunge yesterday, US/SAM origin, Feb delivery at $238.86 per ton – equivalent Fob Santos at +85ch (should be out of US). SK MFG passed its corn tender today. Rumors Indonesia will postpone B40 till July – Ramadan will be held in March. Arg traded SBO for Dec at +600z, which makes US cheaper CFR India. Smeal sales in China surged. In two days, 1.4 Mi tons (80% for deferred delivery). Trades reported in Guangdong, North of China and Jiangsu for July and August delivery.

Soybean Paper MKT – Nov 20

(daily variation)

Feb ?? vs +60sh (+5)

Feb-Mar +70sh vs ??

Mch +35sh (unch) vs +23sh (-2)

Apr +35sk (+5) vs +23sk (+3)

Apr-May +43sk vs +31sk

May +50sk (+5) vs +40sk (+3)

Jun +60sn (+5) vs +45sn (unch)

Jul ?? vs +55sn (+5)

Trades: no reports