PSF: 15_12_2025

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 07/11/2024 08:59

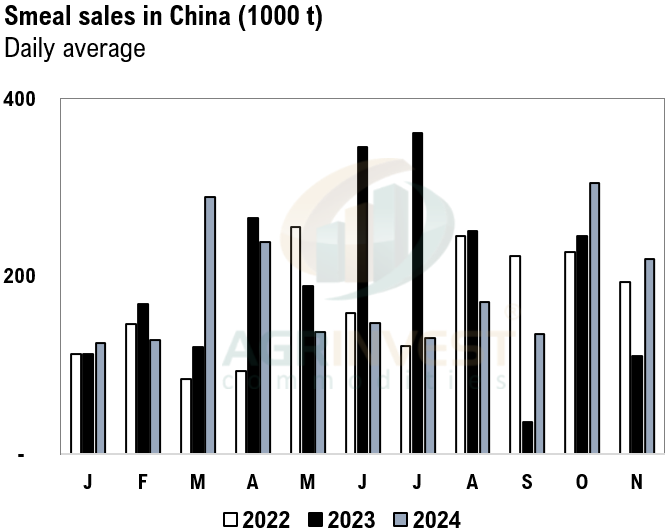

China resumed soybean purchases. Trades USG and PNW (04), Nov-Dec shipment. China also bought Dec and new crop in Brazil. Smeal and oils in DCE continue to rise - Board crush is good for whole curve. Less than 24 hours after Trump’s victory, Xi Jinping congratulated him and his entire team – it took 20 days when Biden became president. Good smeal sales today. Total of 370k tons, 60% for deferred delivery – probably for JJAS delivery; basis down 20 RMB/t in Guangdong. Corn farmer selling in Brazil was strong yesterday. More offers are showing up Fob Santos for NDJ shipment. Brz is the most expensive for this window. Arg traded SBO higher for late Nov and Dec ystd – US seems cheap for Asia. Good soybean farmer selling in Argentina – this month 720k tons (4 days). In Brazil, soybean farmer selling is running below the average – daily average this week at 233k t vs LW at 460k tons. South Korea NOFI bought corn from CHS at +192H, US/SAm origin, Feb delivery. The last tender on 29 Oct traded at +185H and +195H. NOFI also bought Feed wheat at $266.92 per ton CFR, January delivery – the spread vs corn is widening. Brazilian CB increased Selic rate yesterday by 50 bpts, above expectations – the yield diferencial Brz-US is expected to widen to 6.5 percent points till the end of the year (it was 5 till Sep).

Soybean Paper MKT – Nov 06

(daily variation)

Feb +105sh (+20) vs +75sh (+10)

Mch +63sh (+23) vs +35sh (+5)

Apr +59sk (+23) vs +38sk (+16)

May +65sk (+18) vs +48sk (+10)

Jun ?? vs +50sn (+7)

Jul ?? vs +60sn (+5)

Trades: No reports