O tripé do Trump e o impacto para os grãos

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 16/08/2024 08:46

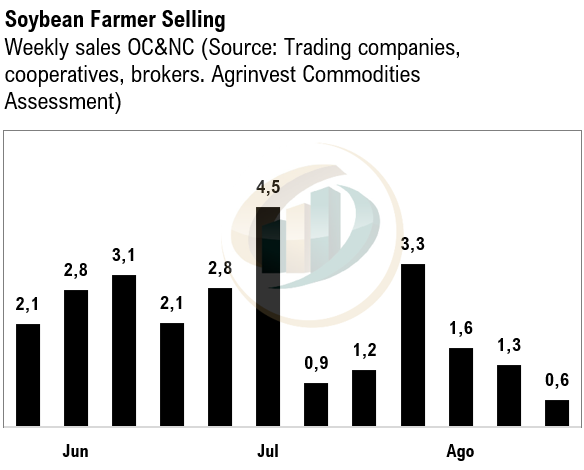

Oil and meal premiums in Brazil rallied this week. The rise in meal prices is due to lack of beans mainly in Mato Grosso, as well as concerns over smeal quality. It’s challenging to find meal in the market that meets export standards, and those who do have it are already committed to their own programs. Crushers in China have made similar comments regarding this year's soybeans. For oil, the increase in premiums is driven by a combination of rising soybean costs in Mato Grosso (basis) and growing demand for biodiesel – fees are rising. Trades were reported yesterday at +100V and +150V for October oil (Fob Paranaguá). Oil premiums in Up River are also rising. The sharp rise in meal and oil premiums in Brazil this week for nearby shipments has led to improved crush margins. As a result, we will likely see crushers extending purchases, which could further reduce the availability of soybeans for export. Soymeal sales in China improved this week, totaling 775,000 tons—200,000 tons more than the previous week. The proportion of future delivery to spot delivery increased from 33% to 56%. Ag futures in DCE bottomed this week, improving the DCE board crush margins. More trades were reported today from the US Gulf for October and November, and from PNW for October. Assuming this pace continues, soybean farmer sales this week will likely close at only 400,000-600,000 tons, combining both crops. This marks the slowest week of the season by far.

Soybean Paper MKT – Aug 15

*(daily variation)

Sep +130sx (-15) vs +115sx (unch)

Out ?? vs +110sx (unch)

Feb +42 (unch) vs +30sh (+2)

Mch +25sh (+2) vs +15sh (-2)

Apr +19sk (+1) vs +15sk (+1)

May +45sk (+5) vs +22sk (-3)

Jun +40sn (unch) vs +20sn (+5)

JJ +48sn vs +25sn (unch)

Jul +55sn vs +30sn (+5)

Trades: no trades

Cargo Market (Santos/Tuba):

FH Sep 24 ?? vs +120sx

LH Sep 24 +150sx vs ??

FH Feb 25 ?? vs +35sh

FH Mar 25 ?? vs +20sh

LH Mar 25 +35sh vs +20sh

LH Apr 25 ?? vs +15sk