NOAA aumenta as chances de La Niña a partir da primavera

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 16/07/2024 08:35

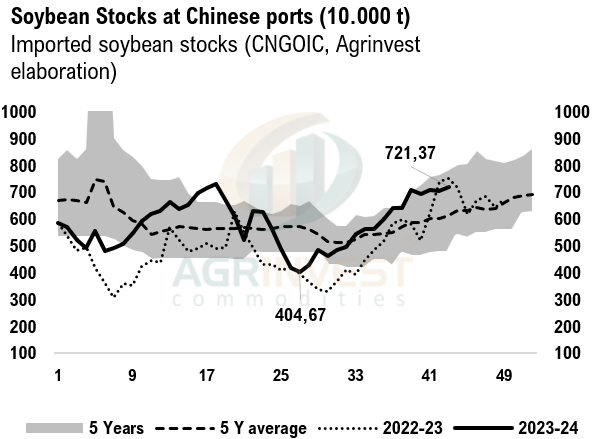

Soybean premiums FOB continue to strengthen. Farmer selling of soybeans and corn was minimal yesterday. Bean oil prices in Brazil are crazy, with Mato Grosso trading equivalent Fob at +400Q for spot delivery. Logistics operators in Brazil expect a rebound in Madeira River levels soon—the water level is linked to Andes snowmelt. Traders estimate 10 corn cargoes traded last week. Arg UP River levels put a cap on FOB levels in Santos. This week, FX traders will keep their eyes on the announcement from Brasília about government expense cuts—two weeks ago, the Finance Ministry promised cuts of R$ 25 billion ($4.5 billion) but did not provide any details. The rate curve is still steep, indicating high skepticism. Soymeal and soybean oil sales in China remain very thin. Soybean and meal inventories at ports grew again last week – soybean stocks at 7.2 million tons, the largest since July 2023. The crush margin in China for the new crop (March and April) is healthy, supporting more trades.

Soybean Paper MKT – July 15

*(daily variation)

Aug 24 +60sq (+3) vs +50sq (+2)

Sep 24 ?? vs +100su (+3)

Feb 25 ?? vs +0sh (unch)

Mch 25 -7sh (+3) vs -15sh (unch)

Apr 25 ?? vs -30sk (-5)

May 25 ?? vs -20sk (unch)

Jun 25 ?? vs -20sn (unch)

Jul 25 ?? vs -15sn (unch)

Trades: Aug24 tdd at +55sq

Cargo Market (Santos/Tuba):

LH Aug24 +85sq vs ??

FH Mch25 -25sh vs ??

05-20 Apr25 ?? vs -20sh