PSF: 15_12_2025

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 20/06/2024 08:05

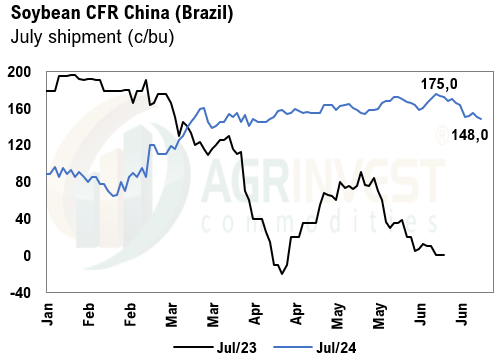

Soybean trades reported on the CFR and FOB at lower levels. Trades for July at +148sn, the lowest level in more than three months. The drop can be attributed to long liquidation and a smaller corn program in Brazil for July. The Brazilian Central Bank decided to hold the Selic rate at 10.5%. The market feared a split decision like the previous one. Additionally, President Lula must decide where the government will cut expenses, which is the main focus for rates and the FX – the government will send the message to the market, higher growth leverage by higher/unsustainable expenses, or more efficiency and pro-market decitions. The outflow from emerging markets has been a trending trade. Fertilizer prices in Brazil have spiked, increasing input costs. Producers in Brazil have intensified barter, acquiring MAP for the 2024-2025 soybean crop – fertilizer prices are not attractive, but timely logistics must be guaranteed. For 2025 safrinha corn, producers are facing very expensive urea and cheaper seeds. Overall, input costs are higher for both soybeans and corn in 2025.

Soybean Paper MKT – June 19

*(daily variation)

Jul 24 +35sn (-3) vs +25sn (-5)

Aug 24 +62sq (+2) vs +43sq (-8)

Sep 24 ?? vs +50su (unch)

Feb 25 ?? vs -25sh (unch)

Mar 25 -20sh (+5) vs -40sh (-5)

Apr 25 -25sk (unch) vs -45sk (unch)

May 25 ?? vs -40sk (unch)

To start your free trial please click here