PSF: 15_12_2025

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 19/06/2024 08:30

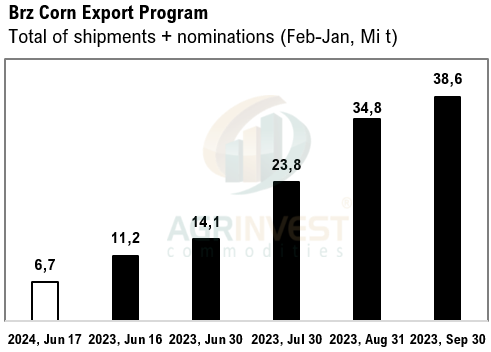

Farmer selling of soybeans and corn yesterday was very disappointing, despite the FX rally. Farmers were willing to sell, but due to the widening bid/offer spread, Agrinvest brokers couldn’t confirm many trades. Crush margins in Brazil improved due to strong demand for oil and soybean meal in the domestic market, especially in Mato Grosso – soybean basis hit at the high of the year this week. The lower soybean basis in the South of Brazil also helped. The Real weakened again against the Dollar as investors await the Copom meeting (like FOMC), closing at 5.44, making it the worst-performing currency among emerging markets in 2024. Origination is strangely slow for both corn and beans, with figures between 200,000-300,000 tons for corn and 400,000 tons for soybeans (65/35 OC/NC). Producers in Brazil intensified barter, acquiring MAP for beans 24-25 – fertilizer prices are not attractive, but they have to guarantee timely logistics. For 2025 safrinha corn, producers are facing very expensive urea. In the spot market, farmers are maintaining prices with replacements of around +80/75u cents per bushel for Santos and Northern Corridors – 20 cents above Fob. In the latest hydrological bulletin from the state of Rondônia, in the North of Brazil, the level of the Madeira River is a real concern for the corn program. The Madeira is at 4.55 m, compared to 8.39 m last year. The Tapajós waterway is also lower than last year—both rivers comprise the main waterways for Northern Arc ports. The corn lineup has grown by 300,000 tons since last week, currently at 1.36 million tons, while this time last year it was at 3.6 million tons. Clearly, with lower margins in origination and slower farmer selling, exporters keep extending the July soybean program, putting pressure on CFR levels. Total soybean nominations are at 10.4 million tons. Overall, the two commodities have 5 million tons less in their lineups compared to the same period last year, which tells me it is not time to negotiate TOP´s for the next season.

Soybean Paper MKT – June 18

*(daily variation)

Jul 24 +38sn (-22) vs +30sn (-5)

Aug 24 +60sq (-20) vs +50sq (unch)

Sep 24 ?? vs +50su (unch)

Feb 25 ?? vs -25sh (-5)

Mar 25 -25sh (-10) vs -35sh (+2)

Apr 25 -25sk (unch) vs -45sk (unch)

May 25 ?? vs -40sk (unch)

Trades (paper): Aug 24 at +55sq

Trades (Cargo Santos): 5-20 Jul at +32sn