A semana foi marcada por frustrações para os programas americanos de exportação

Brz Soybean Market - Recap: Paper Market yesterday strengthen a bit for both crops. Farmer selling is being very slow this week, mainly because of BRL strength – on of the best performing currencies of the week. Agrinvest Brokers estimated farmer selling of 1.2 million tons this week, with 50/50 between old and new crop. Soybean meal premiums retreated yesterday by $4 per short ton for September and by $2 per short ton for October shipment. Margins in Brz improved a bit again, but it is still negative. Agrinvest brokers said it´s being difficult to get offers for spot delivery in the South of Brz – main crushers region. The origination cost of soybean in the North of Brz is getting more expensive for old crop. Truck freights are becoming more expensive. Tradings in Mato Grosso started their barter campaign for 2024/25. The replacement cost FOB is close to the levels for 2024. Reports of coops in Parana with no room for corn. The corn harvest in Parana just reached 48%, way behind the historic average. The storage pressure will increase. Will farmers sell corn or beans? Many farmers have input and loans to pay out up to the end of this month, or up to the end the 1H of September. More traders on CFR China for OND out of the US. The number of cargoes traded this week was way weaker than the last 4 weeks. Soybean sales in China lost the momentum. They say feed mills are well covered for OND.

Paper MKT close

Oct +70sx vs +50sx

Nov ?? vs +52sx

Feb -50sh vs ??

Mar -80sh vs -125sh

AM -95sk vs -110sk

May ?? vs -115sk

Trades: Traded at +65sx for Oct and +60sx for Nov

Logistics: Some points that caught my attention this week regarding logistics in Brazil:

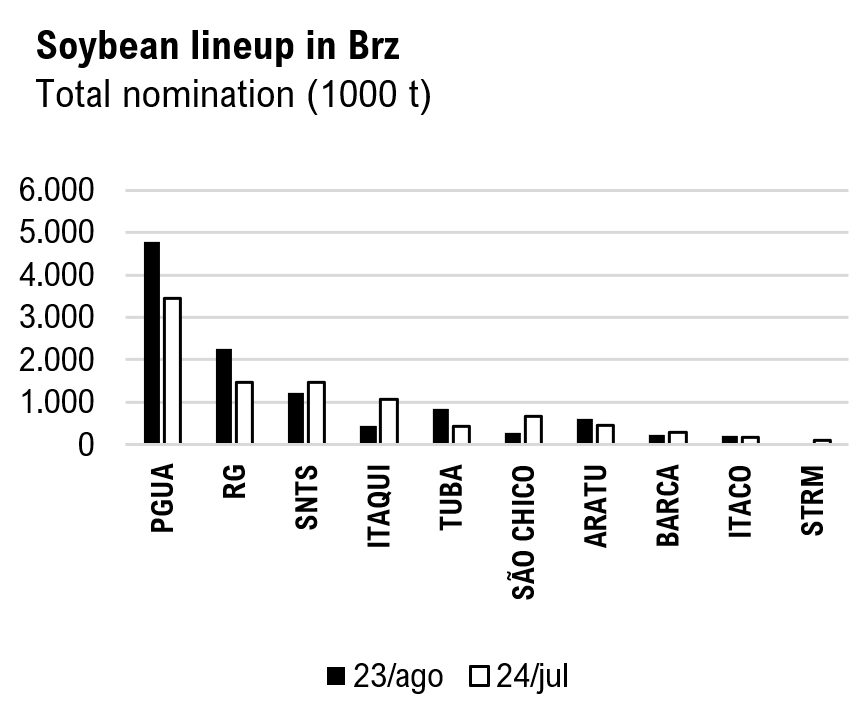

1) soybean nominations at the Port of Paranaguá continue to grow. On July 23rd, soybean nominations in Paranaguá were at 3.5 million tons. On the 23rd of that month, nominations reached 4.75 million. The waiting time in Paranaguá is 46 days, increased by 3 days this week. Whoever sells a cargo in Paranaguá for October knows that the BL will come out in December. For corn, this is a problem for those who sell in the interior. It will only start receiving quotas for trucks at the end of November, adding more pressure on the storage capacity. I heard that large domestic consumers bought 1 million tons of corn from cooperatives in Paraná. Even so, if Paraná and Mato Grosso do Sul states do not have Paranaguá as and corridor, it will be a major inconvenience for corn storage.

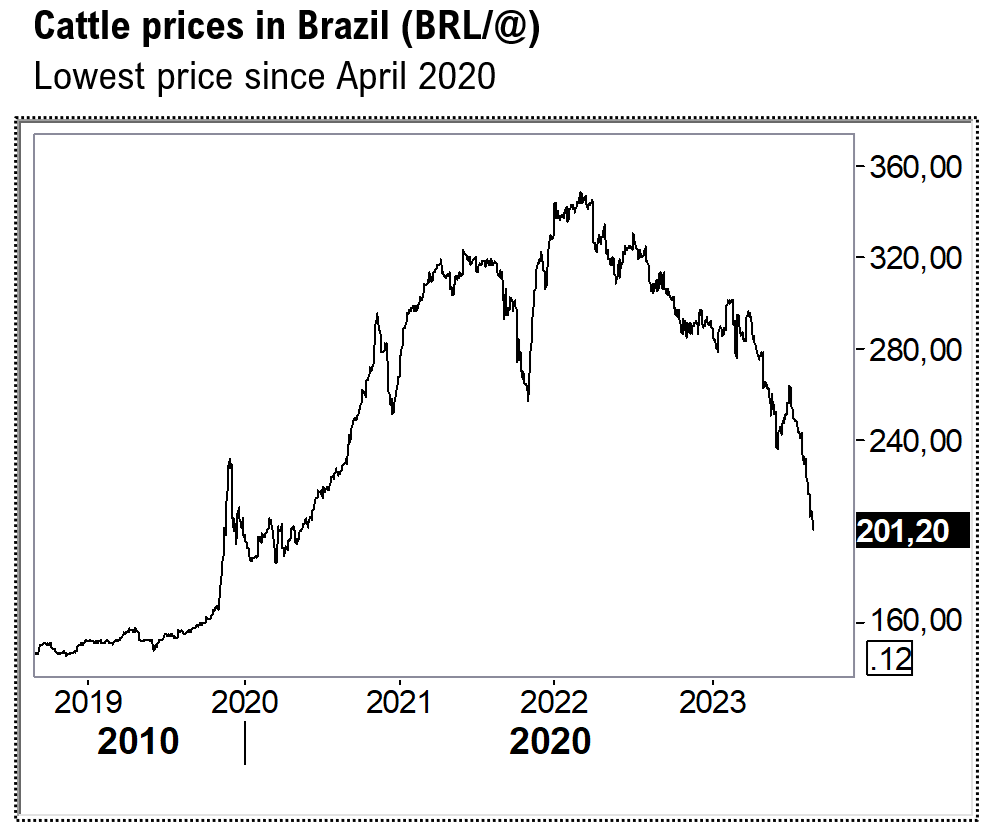

2) producers and cooperatives in the West of Mato Grosso and Rondônia are already saying that the trading companies in Porto Velho terminals are buying soybeans for shipment from April onwards. Those who needs February logistics will suffer big penalties. But this already makes it clear that the logistical pressure on Arco Norte will mount. The transition from corn to soybeans will be quick, which will leave corn in this region without buyers. Producers in this region normally sell corn to ranchers, which this year will certainly be a much smaller volume – the cattle prices in Brazil are at the lowest level since covid. I don't know if it's due to this logistics already taken, but this week traders confirmed trades on CFR China at +15/+16/+17sk for June shipment. These levels are very low, below replacement cost on FOB and in the interior as well. In addition, AMPA, the Mato Grosso Association of Cotton Producers, managed to change the date for the end of the sanitary void for soybeans in Mato Grosso. If Mato Grosso receives rains in the next days, West of Mato Grosso will start planting soybeans 15 days earlier than usual. This means that MT will have soybeans before Christmas. This changes a lot of things, from corn outflow pressure to the behavior of soybean premiums in January.

CFR China Round up:

Soybeans CFR China (Brazil)

Oct +250/248sx vs +240sx

Nov +230/228sx vs +220sx

Feb 24 +90sh vs ?? – trades at 88sh

Mar 24 +35/33sh vs ??

Apr 24 +15sk vs ??

May 24 +25/22sk vs ??

Jun 24 +45sk vs ??

Jul 24 +65sk vs ??

Soybeans CFR China (USG)

Sep/oct +260sx vs ??

Oct +230/228sx vs +220sx

Nov +228/225/220sx vs +215sx

Dec +235sf vs ??

Soybeans CFR China (PNW)

Oct +258sx vs ??

Nov +255/252sx vs ??