PSF: 30_06_2025

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 17/01/2025 08:20

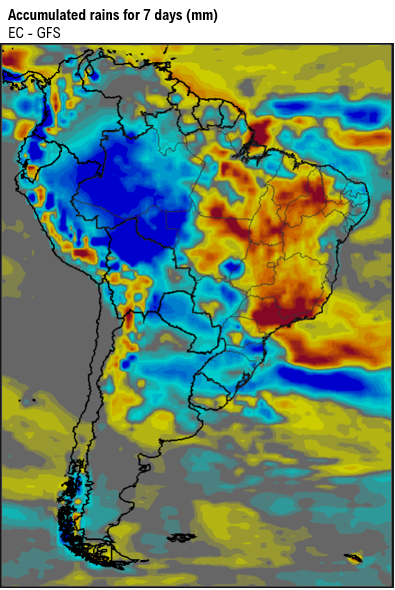

Too much rain across the center of Brazil. Rains favored part of RGDS, Paraná and Paraguay. Soybean nominations at northern ports are increasing and the harvest pace is not keeping up - IMEA with 0.6% harvested as of Jan 10, way lower than LY with 6%. Tradings and local crushers in MT have no alternative except to pay a high premium for immediate delivery; ~80 c/b above export parity. EC and GFS are in great disagreement – EC shows more rains for Argentina and less rains for Central Brazil next week. The GFS shows the opposite. Temps in Mato Grosso are much lower than normal (Max 26 °C; 79 F). Soybean farmer selling 1.9 Mi tons this week – losing the strong pace. CFR China indications jumped 10-15 cents. No trades reported today. Total of 28-32 cargoes reported so far (4-6 ex-PNW for april), versus only 10 LW. Corn ethanol production in Brazil grew more than 20% in 2024 - more than 7 billion liters, 20% of the total output. Brz will have a deficit of ethanol in 2025 of 1-2 billion liters - lower sugar cane production, and more space for ethanol made by corn. Overall, the gross margin of corn ethanol plants remain favorable.

Soybean Paper MKT – Jan 16

(daily variation)

Feb +0sh (+5) vs ??

Mch -20sh (+8) vs -28sh (+7)

Apr -10sk (+5) ?? vs -20sk (+10)

May +10sk (+10) vs +2sk (+12)

Jun ?? vs +7sn (+12)

Jul ?? vs +20sn (+15)

Feb26 -10sh vs -25sh (unch)

Mar26 -20sh (unch) vs -30sh (unch)

Apr26 ?? vs -45sk (unch)

Trades (variation vs last trade): Mar25 at -17sh (+18); May +0sk (+15); Jul +30sn (+25)

Cargo market (Fob Santos + options)

FH Mar ?? vs -30sh

FH Apr ?? vs -30sk

LH Apr ?? vs -20sk

LH Jun ?? vs +5sn

LH Jul ?? vs +15sn