PSF: 14_04_2025

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 17/12/2024 08:23

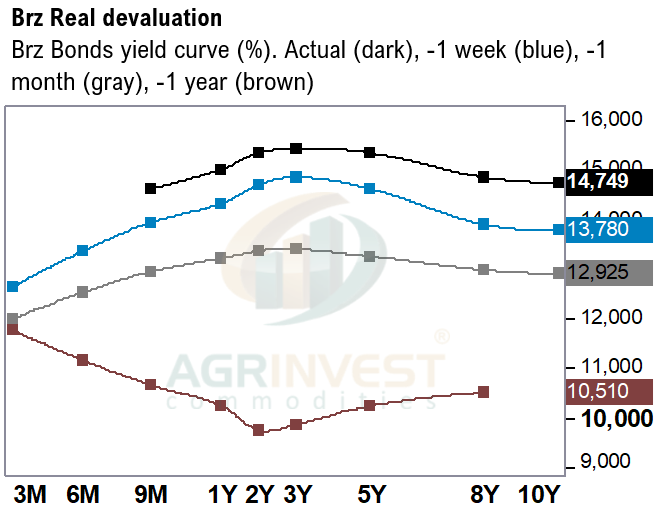

The Brz real continues to be the worst performing currency this month. Yesterday BRL/USD made new highs at 6.148. Lula appeared on a weekly TV show on Sunday. After two brain drainages, Lula made a statement reaffirming his capacity to handle government duties. He emphasized the need for a central bank aligned with the needs of the Brazilian population, claiming that "the only problem is our interest rate being above 10%." The bonds market in Brazil is dysfunctional – “gringos” keep selling bonds. Treasury Notes 2031 yields shot up again. Even with higher FX, tradings are eroding domestic basis. The result is a standstill of flat price and stagnant farmer selling, beans and corn. Sino booked a few cargoes in USG for March and April this overnight. Brazil sold Jan-Feb, Feb-Mar, Mar-Apr and May between last Friday and yesterday. Smeal daily sales in China this week are 286k tons (2 days), 45% lower than last week. The corn FOB market in Brazil started this week with limited activity. There is some interest in the old crop for Jan-Feb shipment, but most exporters have wrapped up their programs. For the 2025 safrinha, the market is more active. Sellers for Aug-Sep at 70u and buyers at lows 60's. The replacement cost for safrinha is close to 60’s in the North – lower for Barcarena, but freight cost is still a wild card.

Soybean Paper MKT – Dec 16

(daily variation)

Feb +40sh (unch) vs +20sh (-7)

Mch +2sh (-3) vs -10sh (-10)

Apr +2sk (-1) ?? vs -10sk (unch)

May +30sk (+2) vs +10sk (-10)

Jun +40sn (-2) vs +20sn (-10)

Feb26 -10sh vs -30sh (-10)

Mch26 -10sh (unch) vs -30sh (unch)

Apr26 -10sk (unch) vs ??

Apr-May26 ?? vs -35sk

Trades: No reports

Cargo market (Santos)

FH Feb +60sh vs ??

10-25 Feb +40sh vs ??

FH Mar +20sh vs ??

LH Mar +15sh vs ??

FH Apr +20sk vs ??