Áudio com informações do abertura do dia no agronegócio

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 05/12/2024 08:31

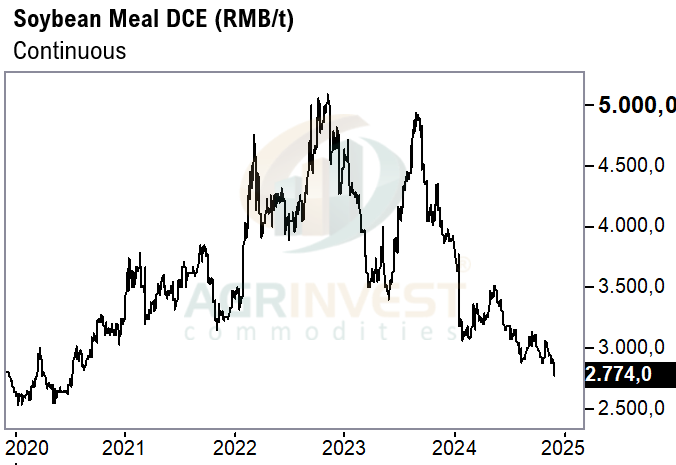

Sino booked more soybean cargoes for March out of the USG – they say more than 10 is possible. Market is assuming Sino will cover March and April in the US. Commercial crushers and tradings keep buying Brz. Trades reported today for March, April, June and July. Yesterday, basis indications CFR slid again, but Fob Paguá didn’t follow. In the interior, the replacement cost for soybeans and corn is also lower – FX effect over grain basis and also logistics. Rumors of corn CFR Spain for August, equivalent to +70u Fob Santos (5-7 cents lower vs LW). In the group call yesterday, producers and agronomists reported no major issues yet for soybeans due to excessive rain – a life cycle extension is very likely they noted. The majority of regions are moving into the R fase. A soybean harvest concentration from Jan 20 till end of Feb is the most likely scenario. Charts are showing an intense rainy pattern during Jan-Feb, similar to 2023. Smeal DCE refresh lows and OI made new highs.

Soybean Paper MKT – Dec 4

(daily variation)

Feb +40sh (unch) vs +25sh (unch)

Mch +8sh (-2) vs +0sh (+15)

Apr +5sk (unch) vs -5sk (+10)

Apr-May +13sk (unch) vs +3sk (+5)

May +20sk (unch) vs +12sk (unch)

Jun +38sn (+3) vs +25sn (+5)

JJ +49sn (+3) vs ??

Jul +60sn vs ??

Trades: Feb at +25sh; May at +13sk (+10sk on Tue); June at +28sn

Cargo Market (Fob Santos-Tuba)

FH April ?? vs -5sk

LH May +45sk vs +20sk (+8)