Panorama Semanal dos Fertilizantes

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 18/11/2024 08:16

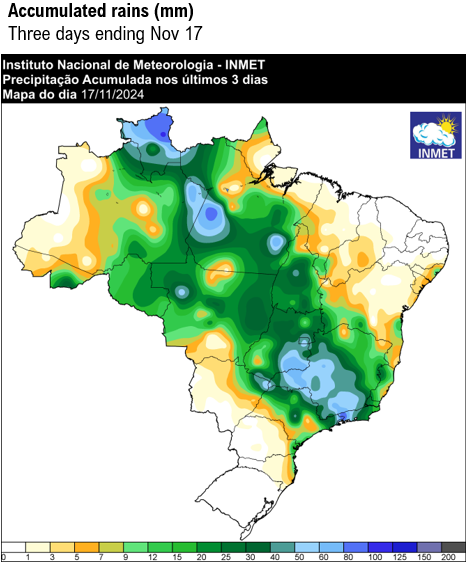

Soybean market CFR China remains quiet. Last week China booked fewer cargoes—just 26, with 16 from the US. Most purchases were for January shipment, mainly by Sino. In the first three weeks of October the purchasing average was close to 50 cargoes. If this trend continues, volumes won’t pick up—bearish for CBOT. Private crushers in China keep trying to secure more Dec cargoes out of Brz, but volume is quite low – Last week only 3 reported. In Brazil, last week was bearish for new crop flat price soybeans – new lows. Futures dropped 18 cents, and March and April shipments fell by 15 cents. In Argentina SBO trades reported on Friday at +500f for Jan – the flat price closed the week firmer once again. China will cancel the UCO rebate from Dec 1st. Big shift for the US SBO balance. Crush margin in Brazil lost half in two weeks – the soybean basis in the interior is quite high and smeal flat price lost all supports. Weather in the Center West to MATOPIBA received widespread and locally heavy rains over the past week. Mato Grosso and Goiás on track for above trend yield. Chances of rain lower next few days, after which scattered to widespread shower activity returns by the 6 to 10 days period. Showers are expected to increase this week after a dry week for Paraná and MGDS with an additional chance for showers for 11-15 days window. These rains are needed to prevent moisture from becoming a yield threat in early Dec. Next 10 day forecast trended drier for core growing region in Argentina, but moderate rain volumes fell late last week from Cordoba and Santa Fe to most of BA and light showers are forecast next two days in the North. Soybean area has increased 600,000 ha to 17.5 Mi (BAGE at 18.6 Mi ha and USDA attaché at 17.2 Mi).

Soybean Paper MKT – Nov 15

(daily variation)

Feb +80sh (unch) vs ??

Mch +45sh (+2) vs +27sh (-7)

Apr +37sk (-3) vs +27sk (-7)

May +55sk (unch) vs +35sk (-2)

Jun +65sn (unch) vs +45sn (-1)

Jul +80sn vs +50sn (unch)

Trades: No reports