Panorama Semanal dos Fertilizantes...

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 29/10/2024 08:53

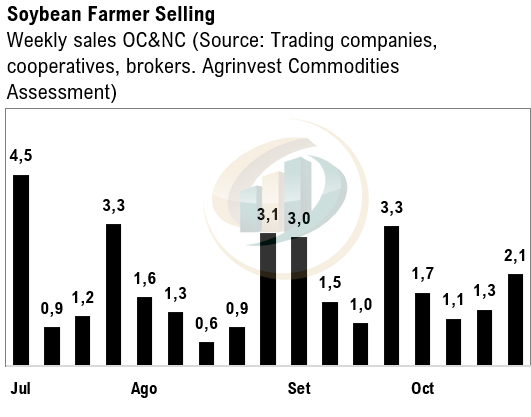

Farmer selling in Brazil and Arg was very low yesterday. In Brazil only 100k tons of beans and 150k tons of corn. Trades reported CFR China out of PNW and USG for Nov and Dec – 04 cargoes reported yesterday afternoon and 01 today. Trades for Feb in Brazil. Trades reported for safrinha corn last week. Trades for Aug shipment at +77u and rumors at +78u – probably more than two. Farmer selling for 2025 was active (estimate of 400k t LW). Tradings are active buyers for safrinha 2025 as origination margin is positive (around 15 cents). Urea prices CFR Brazil fell again, following natural gas and oil – the lower disruption risk in Iran is the main driver. More talks about disruption of smeal supply in China. Changes in CIQ is the main reason for this. We will likely see smeal sales increase for spot due to the fear of crush rate reductions. The lineup for China is set to increase, which could cause large demurrages – the total shipments to China in the last 4 weeks increased from 5 Mi tons to 7.4 Mi tons, and the outstanding position increased from 11 million tons to 18 million tons in the last 4 weeks. Smeal basis in China for August and September delivery lost some ground in all regions. The flat price is very depressed for new crop.

Soybean Paper MKT – Oct 28

(daily variation)

Feb ?? vs +75sh (unch)

Mch ?? vs +45sh (unch)

Apr +55sk (+5) vs +45sk (unch)

May ?? vs +55sk (unch)

Jun ?? vs +53sn (+3)

Jul ?? vs +55sn (unch)

Trades: no reports

Cargo Market (Santos/Tuba):

FH Feb 25 ?? vs +80sh

LH May 25 ?? vs +60sh