Panorama Semanal dos Fertilizantes...

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 25/10/2024 08:46

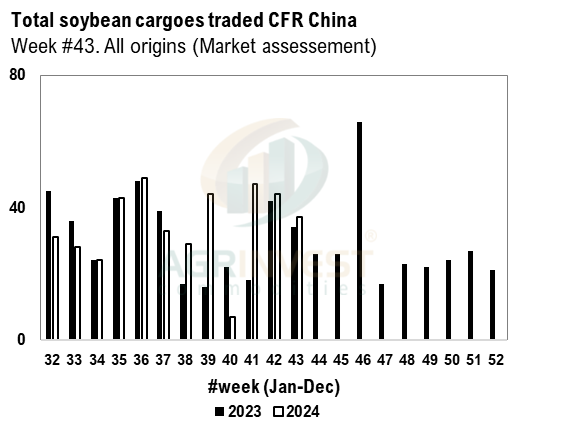

Trades reported CFR China overnight from USG, PNW and Brz new crop – around 35-40 cargoes this week. Demand is concentrated on PNW and NC Brazil. USG basis are higher – trades at 280sx for Nov. The inversion to Brz NC is increasing and the carry between AMJ is increasing to July. Board crush in China is good and smeal sales are not bad – despite the US election. Palm oil refreshed the 2 year high, pulling SBO in Argentina alongside – the SBO flat price in Arg jumped more than $100 per ton this month. SBO US is calculating to Asia. The oil share Fob Arg went from 36% to 40% in few weeks. Oil futures in China are firmer too. In Argentina, a new strike was announced this week: Transportation strike scheduled for Oct 30 for 24hrs (affecting trains, planes, trucks and vessels). Good volumes of rain all over Brazil in the last 5 days, favoring almost all regions. The pattern shifts to less rain down the South, which is good, and more regular rains in the center-North. Storm warnings could cause flooding in Rio Grande do Sul and more disruption in Rio Grande port. Soybean farmer selling in Brazil is at 1.8 Mi tons this week (4 days), 500k tons more than LW (5 days). For corn, the FS is at 1.1 Mi tons, in line with the past one. In Argentina the farmer selling is at 650k tons (4 days), 200k tons lower than LW (5 days). For corn, farmer selling Argentina totaled 675k tons (4 days), versus 463k tons LW (5 days). Smeal sales in China totaled 1 million tons, 150k tons above the last. The flat price of smeal in China remains very depressed.