PSF: 22_12_2025

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 04/10/2024 08:49

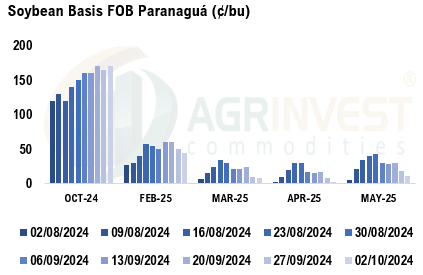

Urea prices are rising in Brazil, and companies have pulled their price lists out. Producers are worried about the costs for 2025 safrinha as fertilizer purchases are well behind the average. Yesterday soybean premiums Fob Pagua slipped again. March and April trades at new lows – April traded at +0sk, lowest level in two months. The spread NC-OC is increasing. The carry from April to May is increasing, and the Feb-Mar inversion is narrowing. The weather is the main reason. The delay won’t be as significant, and the harvest pressure will hit in March for April shipments. Weather charts are still showing good rains over the next 15 days. So far, nothing has changed materially. Temps up north are extreme, and producers are planting cautiously – cotton producers are the most concerned. As of yesterday, soybean farmer selling Arg and Brz is close to 2 million tons and 2.2 million of corn. Ocean freights up a bit, following crude oil – Panamax index up 0.3% WoW. Corn Fob market is more active. Fob Brazil traded firmer for LH Nov (+120z), Egypt bought Brz and Arg (+97z UPR). Traders said more demand to come.

Soybean Paper MKT – Oct 03

*(daily variation)

Oct +175sx (-5) vs ??

Nov +175sx (-5) vs ??

Feb +50sh (unch) vs +35sh (-5)

Mch +10sh (-3) vs +5sh (unch)

Apr +3sk (-2) vs -2sk (-2)

May +15sk (-5) vs +10sk (-2)

Jun +25sn (-1) vs +12sn (-1)

Jul ?? vs +20sn (unch)

Trades: Apr25 +0sk and May at +12sk

Cargo Market (Santos/Tuba):

FH Feb 25 ?? vs +52sh (+2)

FH Apr 25 +15sk vs ??

FH Jun 25 ?? vs +23sk (+3)