PSF: 08_12_2025

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 03/10/2024 09:09

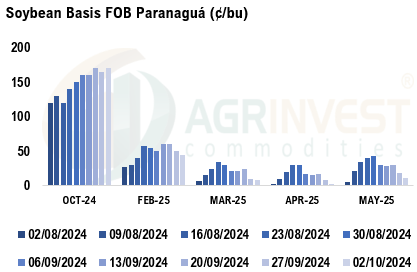

Soybean premiums Fob Pagua slipped yesterday. March and April trades at lower levels than last week – March tdd at +10sh, lowest level in two months. The spread NC-OC is increasing. The carry from April to May is increasing, and the Feb-Mar inversion is narrowing. The weather is the main reason. The delay won’t be as significant, and the harvest pressure will hit in March for April shipments. Weather maps charts are still showing good rains over the next 15 days. Producers are planting cautiously. Urea prices are rising in Brazil, and companies have pulled their price lists out. Producers are worried about the costs for 2025 safrinha as fertilizer purchases are well behind the average. Corn ethanol plants remain aggressive, both in the spot market and for 2025. The number of new and expanding projects continues to grow. All of this is changing the way corn is being priced. Logistics operators haven’t lowered prices for 2025, yet traders are still originating corn in Mato Grosso above the CFR China replacement level. The origination margin is negative in Mato Grosso and at breakeven in other states. Some inquires in soybean market Fob Brz and US for non-Chinese buyers. Ocean freights are lower. For corn, FS in Brazil yesterday was weak, but close to 1.5 million tons in the week. Replacement at +154/157cz spot and +64/81cn5, Fob Santos. We continue to receive demand from MENA for Nov shipments, while in the South we have seen less demand and a bit more offers today. Sellers are looking for +117z for early November STS/Tubarão and around +120/119z for late Nov in Barcarena. The spread between the North and South has narrowed to even, with some players trying to price above Santos.

Soybean Paper MKT – Oct 02

*(daily variation)

Oct +180sx (+5) vs ??

Nov +180sx (+5) vs ??

Feb +50sh (-10) vs +40sh (unch)

Mch +13sh (+7) vs +5sh (unch)

Apr +10sk (-5) vs +0sk (unch)

May +20sk (unch) vs +12sk (unch)

Jun +26sn (-4) vs +13sn (+1)

Jul ?? vs +20sn (-2)

Trades: Mar25 at +10sh; Apr25 +5sk and +2sk

Cargo Market (Santos/Tuba):

FH Nov 24 +175sx (-5) vs ??

FH Feb 25 ?? vs +50sh

LH Feb 25 +65sh vs ??

FH Mar 25 ?? vs +10sh

FH Apr 25 +15sk vs ??

02-20 May 25 +30sk vs ?? – rumors at +30sk (tue)

LH May 25 +30sk (-5) vs +20sk