O tripé do Trump e o impacto para os grãos

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 18/09/2024 08:51

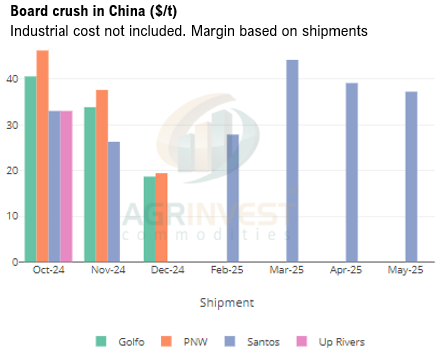

Trades reported last week out of the PNW and Brazil for new crop. Farmer selling of beans and corn has stalled in both Argentina and Brazil. FOB levels in Brazil for both commodities also rose this week – the origination cost increased for both, due to lower BRL/USD and dry weather concerns. Soymeal premiums in Argentina are lower this week. Paraguayan originators are still saying Arg crushers are trying to secure beans for very spot window. They report farmer selling in PY is close to 98%. Crush margins in both Argentina and Brazil decreased this week. Oil futures in China closed higher today. Canadian canola and Australian rapeseed supplies are on the radar – board crush jumped by $5-7 per ton. All eyes are on the rates spread between Brazil and the US bonds, with the Fed and Brazil's Central Bank decisions expected today. Scenarios vary between an increase of 50 bpts and 100 bpts. Weather patterns in Brazil are not changing, with only long-range forecasts showing potential improvement, though confidence is low. Producers in Paraná and Paraguay are actively planting, while the rest of Brazil is waiting for better conditions and more reliable forecasts. The EC had been forecasting rains for western Mato Grosso starting around the 20th of this month, but this week it pushed that to the 27th. Cotton producers in Mato Grosso are still waiting for better conditions to start planting soybeans. A drier October could impact soybean acreage as well as the safrinha window.

Soybean Paper MKT – Sep 17

*(daily variation)

Oct ?? vs +150sx (+10)

Nov ?? vs +145sx (unch)

Feb +70sh (unch) vs +60sh (+5)

15Feb +55sh vs +35sh

Mch +35sh (unch) vs +25sh (+10)

Apr +25sk (unch) vs +15sk (+3)

May +40sk (unch) vs +25sk (+2)

Jun +37sn (-3) vs +27sn (+2)

Jul +55sn (-5) vs +39sn (+4)

Trades: Rumors Feb at +65sh

Cargo Market (Santos/Tuba):

FH Feb 25 ?? vs +60sh (+5)

FH Mar 25 ?? vs +25sh (+5)

FH May 25 ?? vs +25sk

LH Jun 25 ?? vs +35sn (+5)