PSF: 15_12_2025

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 06/09/2024 08:41

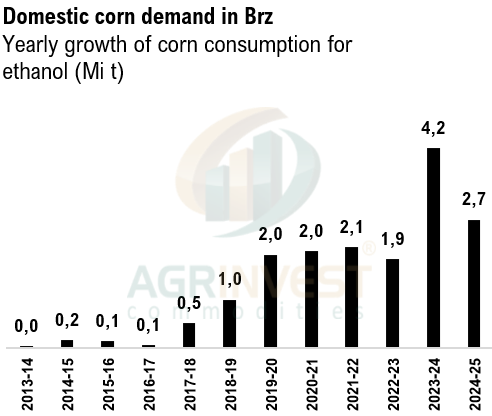

Brazil's domestic demand for soybean oil and corn is set to grow. This week, the Senate approved the "fuel of the future" bill, increasing the ethanol and biodiesel blend for the next five years. The pricing structure in Brazil is shifting, particularly in the North. The smaller oil and corn export program this year is a clear indication – Mato Grosso has the most expensive beans, oil and corn in Brz (replacement Fob). Rapeseed meal futures in China closed the week up 14%, pulling soybean meal higher as well. Sales and deliveries of soybean meal in China surged this week. Soybean premiums in Brazil for the new crop dropped significantly—May fell 30 cents from the peak. The soybean basis spread between the OND and MAM windows CFR China also widened. Crush margins in China for the OND window improved, while margins in Argentina and Brazil deteriorated. Corn premiums FOB Santos are losing support. Bids are lower, and buyers report that CFR levels are now below replacement costs (Fob to CFR). As of September 4th, total corn commitments ion Brz stand at 22.8 million tons, down from 35.2 million tons at the same time last year. Nominations at the ports of Barcarena, Itacoatiara, and Itaqui continue to decline.

Soybean Paper MKT – Sep 05

*(daily variation)

Oct +170sx (unch) vs +145sx (unch)

Feb +60sx (unch) vs +43sh (+3)

Mch +25sh (unch) vs +18sh (unch)

Apr +22sk (+2) vs +11sk (+1)

May +30sk (-10) vs +25sk (-2)

Jun +35sn (-5) vs +28sn (+3)

Jul +45sn (-5) vs +38sn (+3)

Trades: May at +28/27/25sk; JJ at +40sn

Cargo Market (Santos/Tuba):

FH Oct 24 +180sx vs ??

LH Mar 25 +40sh vs ??

FH Apr 25 +30sk vs ??

FH May 25 +40sk vs ??

FH Jun 25 +50sn vs ??