PSF: 15_12_2025

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 04/09/2024 08:36

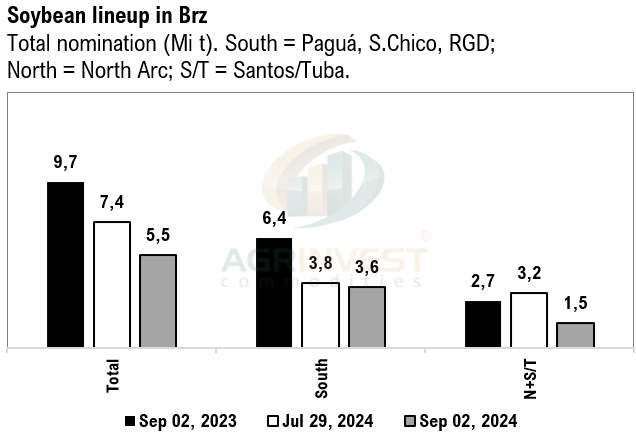

Rapeseed meal futures in China closed very firm again. Soybean meal sales in China have been very active over the past 7 days, with a focus on distant delivery—feed mills are extending their coverage for the OND, which is not a coincidence. Rumors of RSO trades from Russia to China. Soybean oil premiums in Argentina have slipped again. Soybean oil in Brazil is very disconnected from FOB levels—trades reported in Mato Grosso equivalent FOB Paguá to +800V. The crush margin in Brazil for OND is in a good moment, and crushers are extending their coverage, adding pressure on soybean meal premiums. Soybean nominations in Brazil hit a new low, dropping by 700,000 tons to 5.5 million. China purchased multiple soybean cargoes from the PNW and USG. Brazil sold one cargo for October and one for May. The replacement cost CFR China for new crop from Brazil remains expensive, supporting FOB levels. The water levels of the Madeira and Tapajós rivers are extremely low. Traders are rushing to ship as much corn as possible from Miritituba before the terminals shut down. The corn export program is 12 million tons behind last year's pace, and this gap is expected to widen. There’s no significant selling pressure on FOB levels to bring corn premiums down. Overall, the weather in Brazil remains very unfavorable, and weather models show no consensus for the next 3 months—GFS is projecting much drier conditions than the EC.

Soybean Paper MKT – Sep 02

*(daily variation)

Oct +165sx (unch) vs +150sx (+5)

Feb +57 (-3) vs +45sh (unch)

Mch +25sh (-10) vs +20sh (-5)

Apr +25sk (-10) vs +15sk (-10)

May +45sk (unch) vs +30sk (-10)

Jun +50sn (unch) vs +30sn (-10)

Jul +60sn (unch) vs +40sn (-10)

Trades: Mar25 at +25sh; Apr25 +20sk; JJ25 at +45/40sk

Cargo Market (Santos/Tuba):

FH Mar 25 +0sh vs ?? (Novo Remanso - North)

FH Apr 25 +30sk vs ??