O dólar sobe com força e atinge máximas de R$ 5,41

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 22/08/2024 08:59

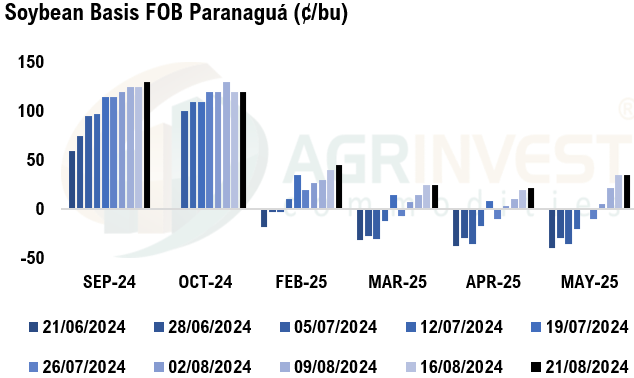

Brokers reported soybean oil trades in Brazil at very high basis levels—Mato Grosso is trading at +1000-1200U equivalent Fob Pagua. The main reasons for this are the soybean crop failure in Mato Grosso, larger biodiesel demand, and too large soybean export program relative to the crop size. Additionally, Brazil’s economic activity is picking up, which will drive higher fuel demand by the end of the year. Soybean oil is helping improve domestic crush margins, pushing up soybean basis in the North—trades reported in Goiás and Mato Grosso equivalent to +360/390sx CFR China. Soybean nominations at the port of Rio Grande have reached 1.75 million tons, the highest volume of the year, making it the main soybean export corridor. Trades reported overnight CFR China for September out of Brazil 8 cents higher than last week. Soybean premiums Fob Paranaguá also traded higher for the new crop, likely due to the absence of farmer selling. Trades were reported out of PNW and USG for September-October and November for non-commercial buyers. Locals noted that PNW worked higher on rail yesterday—trades Fob at +140-145sx, up 7-8 cents. China bought a few palm oil cargoes for December shipment—last week, there were reports of washouts.

Soybean Paper MKT – Aug 21

*(daily variation)

Sep +140sx (unch) vs +120sx (unch)

Out ?? vs +120sx (unch)

Feb +55 (+7) vs +45sh (+5)

Mch +40sh (+10) vs +25sh (+5)

Apr +30sk (+5) vs +20sk (+2)

May +45sk (+5) vs +30sk (unch)

Jun ?? vs +32sn (+2)

JJ ?? vs +37sn (+2)

Jul ?? vs +42sn (+2)

Trades: Trades at +29sh (new high)

Cargo Market (Santos/Tuba):

FH Feb 25 ?? vs +45sh

FH Mar 25 ?? vs +25sh

LH Apr 25 ?? vs +15sk