O tripé do Trump e o impacto para os grãos

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 14/08/2024 08:13

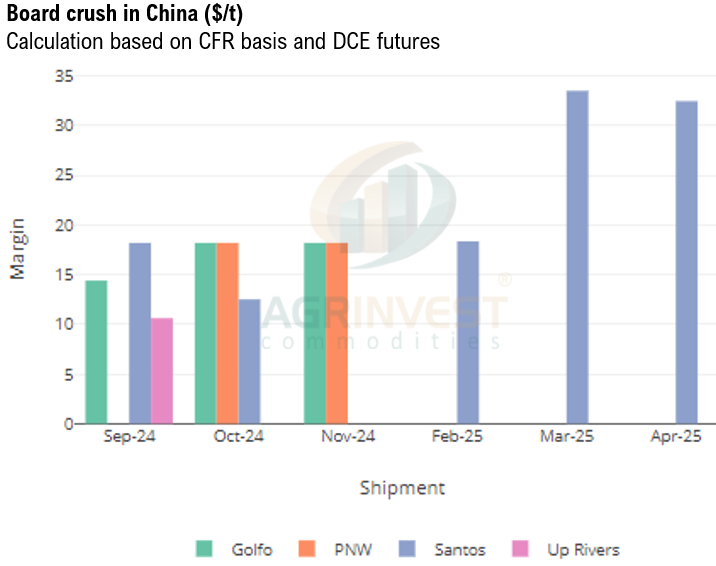

Another very slow day for farmer salling in Brazil. This week, only 200,000 tons of beans were sold – both crops combined. Producers in Brazil are selling more corn – 400,000 tons this week. The pattern is similar in Argentina – nearly a 1:2 ratio over the last 5 days. Soybean nominations at Brazilian ports continue to drop, increasing the difference in total committed to export compared to last year. The only port in Brazil where we see growth is in RGD. Coops in RGDS need to move beans before the wheat harvest in Sep-Oct. Very few trades reported CFR China this week. Trades were reported overnight out of the PNW for Sep-Oct (rumors of 02 cargoes). Ocean freight rates are falling everywhere, especially from Santos to Asia – showing smaller demand compared to last year (LY). Overall, crushers in China are still waiting for a further drop in USG levels to jump in. Board crush in China remain depressed, even with cheaper beans. Additionally, meal daily sales in China are really depressed. Meal flat price (futures + basis) is in carry, and the supply of beans seems plentiful – the meal ownership of feed mills in China is really low.

Soybean Paper MKT – Aug 13

*(daily variation)

Sep +140sx (unch) vs +120sx (-5)

Feb ?? vs +28sh (-2)

Mch +25sh (unch) vs +21sh (+6)

Apr +20sk (unch) vs +15sk (+3)

May +30sk (+3) vs +25sk (+3)

Jun +45sn (+5) vs +20sn (unch)

JJ ?? vs +25sn (unch)

Jul ?? vs +30sn (unch)

Trades: March at +22sh (new high)

Cargo Market (Santos/Tuba):

FH Sep 24 +145sx vs ??

FH Feb 25 ?? vs +35sh

FH Mar 25 ?? vs +20sh

LH Apr 25 ?? vs +15sk