CALL GROUP

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 02/08/2024 08:49

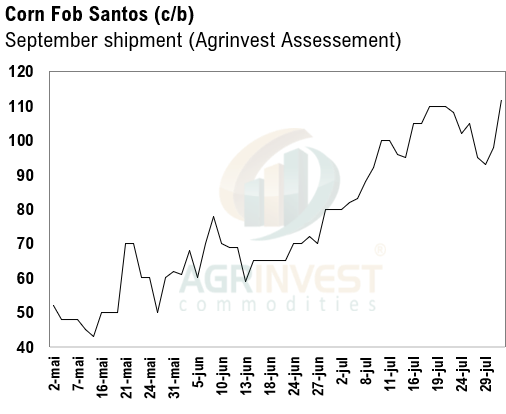

More soybean trades reported in the CFR China for September out of Brazil, and for October shipments out of the USG. Some of this week’s trades out of the US were for commercial crushers, which is a good sign. Brazil is still offering beans for September and October, but the volume is limited. If we assume a 97 million ton export program (Jan-Dec), then Brazil has 16 million tons left to offer (all origins). Last year, it was 22 million tons. Soybean and corn premiums in Brazil climbed this week. For soybeans, premiums rose by 15 cents. Yesterday, trades for March at +8sh, 15 cents above last Friday's level (trades at -7sh). Corn also moved up, with rumors of September shipments out of Santos at +105-110u. Bids for OND (October, November, December) rose by 10 cents this week. US corn is pricing more competitively for Central America and North Africa, while Santos remains the cheapest option for Asia. This week, news circulated that China has imposed restrictions on feed wheat imports through the duty-free zones. The message is clear: China doesn’t need to import feed grains currently. Wheat and corn in China's cash market continue to fall. Feed production in the first half fell by 4% year-over-year. Ethanol plants in Mato Grosso are bidding 60-70 cents per bushel over FOB levels for the 2025 safrinha. The summer corn crop in Brazil is set to decline, and in Argentina, there is a consensus about lower corn acreage due to low profitability and corn leafhopper infestation.

Soybean Paper MKT – Aug 01

*(daily variation)

Sep +135sx (+5) vs +100sx (-10)

Feb +33sh (+3) vs +25sh (+3)

Mch +13sh (-2) vs +5sh (+5)

Apr +10sk (unch) vs +0sk (+5)

May +20sk (unch) vs +5sk (+5)

Jun ?? vs +7sn (+2)

Jul ?? vs +15sn (+5)

Trades: Fev25 at +30sh and Mar25 at +8sh

Cargo Market (Santos/Tuba):

Sep 24 ?? vs +115sx

Oct 24 ?? vs +115sx

FH Feb 25 ?? vs +25sh (+10)

FH Mar 25 +30sh vs +5sh

FH Apr 25 +15sk (-5) vs +5sk

LH Apr 25 ?? vs +0sk