Áudio alerta sobre EUA

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 01/08/2024 08:59

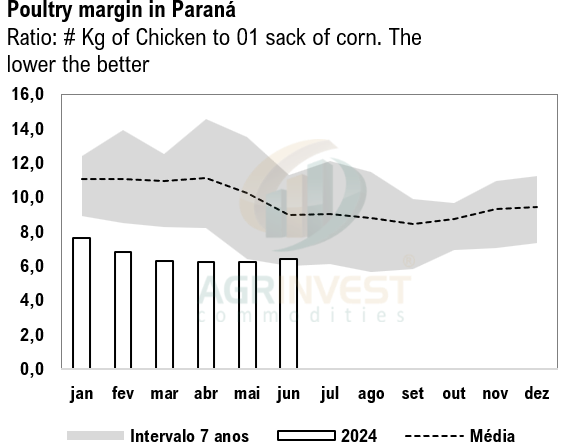

The CFR China market was more active overnight, thanks to improved board crush margins for both crops. Crushers bought September and new crop beans from Brazil. Rumors Sino secured more cargoes from the US for September, October, and November (6-7 cargoes). However, soybean meal basis in China remains under pressure on spot, for August, and September delivery. Daily soybean meal sales dropped again, and soybean oil sales remain very slow. Wheat prices in China continue to fall, with wheat prices below corn in some regions. In the Brazilian corn market, the majority of trades were for domestic users, with replacement in the southern region (Paranaguá/São Francisco do Sul) at around 140/145 cents. Margins for poultry and hog producers in Brazil have improved significantly—the best in 4 years—which could provide more flexibility to pay a little more if necessary. FX traders kept their eyes on the Brazilian Central Bank. Yesterday, the Central Bank board suggested that “if any monetary policy action were to be taken, it would be more tightening”—inflation expectations are rising, like rates.

Soybean Paper MKT – July 31

*(daily variation)

Aug ?? vs +100sx (+5)

Sep +130sx (-10) vs +110sx (+5)

Oct +140sx vs +100sx

Feb +30sh (unch) vs +22sh (+2)

Mch +15sh (+5) vs +0sh (+3)

Apr +10sk (unch) vs -5sk (+3)

May +20sk (+5) vs +0sk (-5)

Jun ?? vs +5sn (unch)

Jul ?? vs +10sn (-5)

Trades: no trades

Cargo Market (Santos/Tuba):

FH Feb 25 ?? vs +15sh

LH Feb 25 +45sh vs +10sh

FH Mar 25 +30sh vs +5sh

FH Apr 25 +20sk (-5) vs ??

LH Apr 25 ?? vs +0sk