PSF: 15_12_2025

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 24/07/2024 08:49

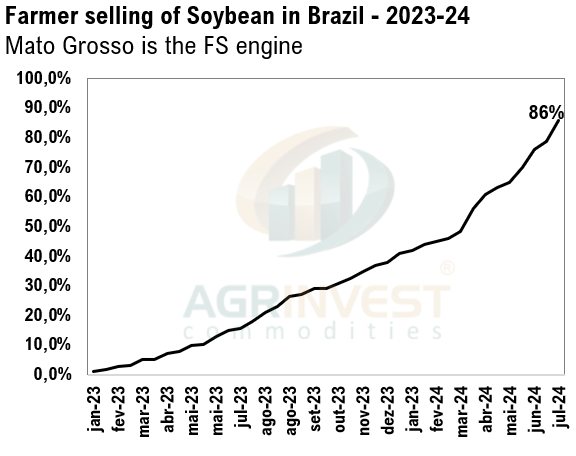

Soybean premiums FOB Paranaguá and CFR China surged 30 to 40 cents per bushel in just a few days. However, by the end of the day, both CFR and FOB premiums showed signs of weakening. Yesterday afternoon (Western time), few tradings lowered their offer indications by 5 cents for both old and new crops. Throughout the day, Fob levels also decresed for both crops. Farmer selling in Brazil was slow again, totaling only 1 million tons for both crops, but demand from Chinese crushers seemed to be impacted by the worsening crush margins for both crops. The quality of soybeans up North is becoming a serious challenge for the continuation of the export program in Brazil. Traders are attempting to manage this by relocating beans from different regions, which is costly. The nominations in the North and at Santos/Tuba are decreasing rapidly – besides that, FS in MT is close to 90%. Corn premiums appear to have reached a temporary ceiling. The US Gulf is cheaper for many destinations. I've heard that Argentina has also dropped its levels. Moreover, farmer selling in the last 10 days was quite strong, increasing the likelihood of a downward adjustment in premiums. Brokers in China noted that margins for imported corn are favorable, based on CFR values and local prices in Southern China. Private demand is contingent on the quotas for free-trade zones. Interest rates in Brazil climbed again, still reflecting the government's vague announcements regarding expense cuts for 2025. The monthly rollover of the FX curve has increased again, influenced by the rates – the exchange rate for April reached 5.77, the highest since July 2. The higher the deferred FX rate, the cheaper the logistics.

Soybean Paper MKT – July 23

*(daily variation)

Aug +60sq (-5) vs +40 (unch)

Sep +120sx (-10) vs +108sx (-7)

Feb +50 (+5) vs +30 (+10)

Mch +17 (-8) vs +5 (unch)

Apr +30 (unch) vs +5 (-5)

May +60 (+5) vs +15 (unch)

Jun ?? vs +5 (unch)

Jul ?? vs +15 (+5)

Trades: Aug24 at +55sq (-5); Sep24 +118sx (-7); Mar25 at +13sh/+12sh (-3)*

*versus last trades

Cargo Market (Santos/Tuba):

LH Aug 24 +140sx vs ??

FH Sep 24 +145sx vs +125sx

FH Feb 25 ?? vs +25sh (-5)

LH Feb 25 +40sh vs ??

FH Mar 25 +40sh vs +15sh (-10)

FH Apr 25 +15sk vs ??

LH Apr 25 ?? vs +5sk

LH May 25 ?? vs +10sk