A piora da relação China-Canadá é altista ou baixista para a soja?

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 23/07/2024 09:04

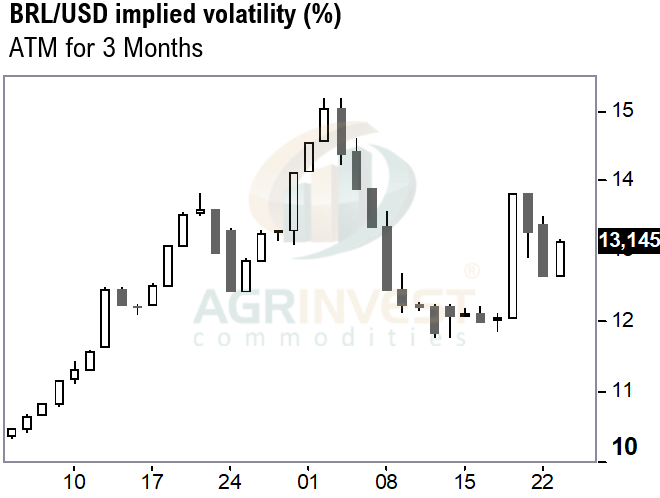

FOB soybean premiums have reached new highs for the new crop. March traded at +15sh – about 60 cents above the levels traded one month ago. Farmer selling of beans remains very subdued, while corn is running in a good pace. Crushers in Brazil are trying to cover August in the South and September in the North – the exception is Tocantins, where coverage extends to the end of October. The crush margin in Brazil is close to breakeven in Mato Grosso and between $20 to $30 per ton for Goias and the Southern states – for August (including costs). In Argentina, crush margins have deteriorated – local soybean basis are firmer. Brokers have reported that Sino has purchased one soybean cargo from Argentina for Aug-Sep – tradings registered equivalent soybean export licenses yesterday. China will auction 1 million tons of beans this week – totaling 10.8 million this year. Corn brokers commented that margins for imported corn are good, based on CFR values and local prices in the South of China. Private demand depends on the quotas for free-trade zones. FX and rates in Brazil are still reflecting the ambiguity of the government's announcements regarding expense cuts for 2025 – the implied volatility of BRL/USD ATM options is climbing again.

Soybean Paper MKT – July 20

*(daily variation)

Aug +65sq (unch) vs +40 (-5)

Sep +140sx (unch) vs +115sx (unch)

Feb +45 (unch) vs +20 (-3)

Mch +25 (unch) vs +5 (unch)

Apr +30 (+5) vs -5 (-5)

May +55 (+5) vs +0 (unch)

Jun ?? vs +0 (unch)

Jul ?? vs +10 (+5)

Trades: March 25 at +15sh

Cargo Market (Santos/Tuba):

FH Sep 24 +170sx vs ??

FH Feb 25 ?? vs +30sh (+5)

FH Mar 25 +40sh vs +25sh

LH Apr 25 ?? vs +10sh