Panorama Semanal dos Fertilizantes...

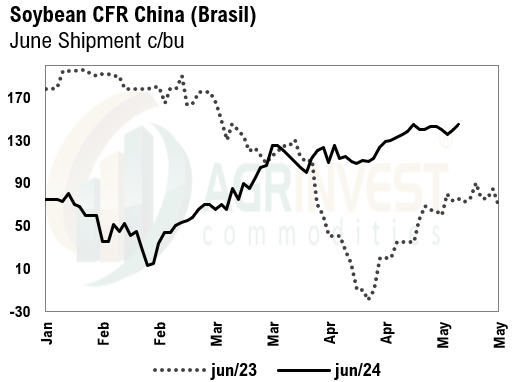

BRL/USD closed higher. Farmer selling of soybeans was close to 1 Million tons and corn 300,000 tons. In Argentina the farmer selling of corn and beans remains very slow, adding some support to soybean meal and corn premiums. Yesterday, soybean June shipment in Paranaguá was traded at +20sn and July at +35sn—new highs. For June, this level of trade calculates +158sn CFR China, assuming a 10 cent spread between paper and cargo premiums. Consequently, the indications in the CFR were firmer overnight – rumors of June at +145sn (5 cents higher compared to Tuesday overnight). Crush margin in China is good for June and July and local crushers are still covering May – brokers estimated at least 7 cargoes were traded between yesterday afernoon (Brz time) and today. Daily soybean meal sales only reached 65,200 tons, 57,000 tons less than yesterday. The live hog futures curve on the DCE is flattening – the curve is losing its carry. It seems that the market is not confident about the lower supply for the 2nd semester.

Soybean Paper MKT – April 24

*(daily variation)

May 24 ?? vs -10sk (-5)

June 24 +20sn (unch) vs +12sn (unch)

Jul 24 +38sn (unch) vs +29sn (+2)

Aug 24 ?? vs +32sq (-5)

Feb 25 -25sh (unch) vs -45sh (-3)

Mar 25 -45sh (unch) vs -62sh (-2)

Apr 25 -40sk (unch) vs -65sk (+3)

May 25 -35sk (unch) vs -60sk (-2)

Jun 25 ?? vs -55sn (-5)

Jul 25 ?? vs -50sn (-5)

Trades (Fob Paranaguá): June at +20sn; July at +35sn

Soybean market: Soybean premiums continue to rise in both FOB and CFR markets. Yesterday, June traded at +20sn and July at +35sn in Paranaguá. Back in late January, June was traded at -95sn. In the CFR China, May shipment traded at +140sn, and June at +145sn – season's high. Margins in China are favorable for June and July, while in Brazil, industries need to extend their coverage. In Mato Grosso, industries are purchasing for July, but in other states, they are still buying for May. Unlike China, margins in Brazil are poor. Additionally, the withdrawal from biodiesel contracts is very slow, pressuring both margins and processing. I heard that in Mato Grosso, one processor is operating at 50% of its capacity because their tanks are full. If this situation is widespread, processing will start to decline in Brazil, potentially reducing the supply of meal in the market—from January to the 22nd of this month, Argentina and Brazil's meal export programs increased by 2.2 million tons compared to last year. Yesterday's soybean farmer selling reached 1 million tons, nearly double the average of the last two days, with most of it going to local industries. China continues to cover May and June, showing that their coverage is also short—with May coverage over 95%, June at 55%, and July still below 20%.

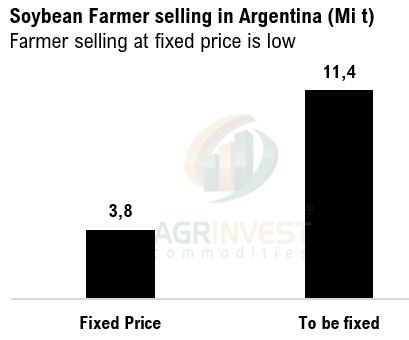

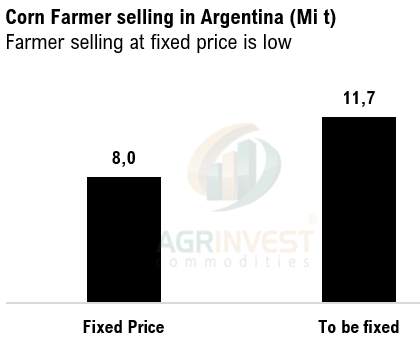

Corn market: In Argentina, the farmer selling of corn and soybeans at fixed prices continues to move at a snail's pace. Daily sales at fixed prices average 105,000 tons for soybeans, which does not allow for a stronger growth in meal export licenses. This month, meal export licenses grew by only 1.2 million tons, which is minimal for an export program that could potentially reach between 2.5 and 2.8 million tons. The story is the same for corn. Daily fixed price sales average 130,000 tons, which also does not support a rapid increase in export licenses. So far, farmer selling of soybeans in Argentina stands at 15.3 million tons, with only 25% at fixed prices. For corn, the FS is at 19.7 million, with just 40% at fixed prices. This scenario continues to provide some support to the premiums for corn and meal in Brazil. Argentina is offering corn (Panamax) for July shipment at +45sn, which would be equivalent to +65sn in Santos. Yesterday's offers in Santos were at +55sn. Brazilian corn is the most competitive CFR Asia for JAS window. However, brokers say demand is still not convinced that Argentina will remain more expensive than Brazil. Overall, the corn market remains very slow.

*CFR China Round up – April 25: Trades reported*

Soybeans CFR China (Brazil)

May 24 +138sn vs ?? – Trades at +140sn and +150sk

May-Jun 24 +140/135sn vs ??

June 24 +150/145sn vs ?? – trades at +140sn and rumors at +145sn

Jul 24 +165/163sn vs ??

Aug 24 +185sn vs ??

Sep 24 +220sx vs ??

Feb 25 +98sh vs ??

Mar 25 +72sh vs ??

Apr 25 +65sk vs ??

May 25 +70sk vs ??

Soybean CFR China (ARG)

June 24 +140sn vs ??

Jul 24 +155sn vs ?? (based on replacement, Fob + Freight)

Soybean CFR China (USG)

Oct 24 +235sx vs ??

Soybean CFR China (PNW)

Oct 24 +255sx vs ??

Nov 24 +250sx vs ??