Panorama Semanal dos Fertilizantes...

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 23/04/2024 08:31

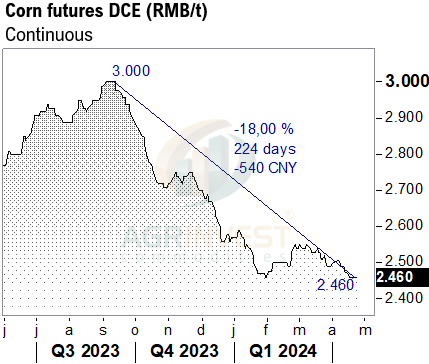

The Soybean-Corn ratio in Mato Grosso “is telling” to producers to hold on to corn. Soybean flat prices remain firm, while corn prices are falling, especially for shorter windows (June and July). This ratio is climbing much faster this year, and the ceiling could be much higher than last year— last year the ratio reached 3.4 in Mato Grosso from July onward and ranged between 2.7 to 3.0 in other regions. Brazilian corn is becoming competitive. Traders have built a long position over the last 4 weeks, recently discounting premiums. Last week, brokers mentioned trades for August and September FOB Santos at +52u and +48u respectively, a drop of 10/12 cents compared to offers we have seen so far – the FX did the job. Yesterday, corn farmer selling in Brazil was 250,000 to 300,000 tons, while the replacement fell to +50' over July for the Northern export corridor and around +80/90' for the southern port corridors—including Santos. After a few weeks with good origination flow, brokers commented on a more active FOB market with offers for almost all shipping periods. Prices have come down, and we see a more defined market from July onwards. Regarding the spot market, there were several inquiries yesterday as Argentina remains expensive. China held another soybean auction of 117,300 tons with no demand. The weather in China has been favorable, keeping corn and wheat prices stable close to the lows—corn prices in the spot market are at their lowest level since October 2020. All feed ingredients in China remain close to multi-year lows, including wheat, wheat meal, DDGS, soybean meal, and other meals.

Soybean Paper MKT – April 22

*(daily variation)

May 24 +10sk (+2) vs -2sk (+3)

June 24 +20sn (+5) vs +5sn (-3)

Jul 24 +40sn (+5) vs +20sn (-5)

Aug 24 ?? vs +25sq (+3)

Feb 25 -25sh (unch) vs -45sh (unch)

Mar 25 -45sh (unch) vs -60sh (+3)

Apr 25 -40sk (unch) vs -70sk (unch)

May 25 -35sk (+5) vs -60sk (unch)

Jun 25 ?? vs -55sn (unch)

Jul 25 ?? vs -50sn (unch)

Trades (Fob Paranaguá): no trades

To start your free trial please click here