Panorama Semanal dos Fertilizantes...

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 22/04/2024 08:21

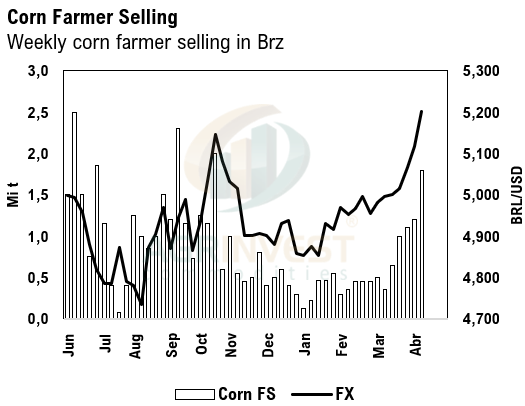

Another week of strong farmer selling in Brazil – Corn at 1.8 million tons and soybeans at 3 million. For corn, last week represented the strongest week since September last year. In the past two weeks, a rising exchange rate and falling corn flat price have helped to reduce replacement cost Fob ports by 20 to 30 cents per bushel, making Brz competitive again. Last week Nofi held a corn tender, with prices between $243 per ton and $248 CFR. At these levels, Brazil and the US were the most competitive. In China, soybean meal daily sales were 115,000 tons, a decrease of 228,000 tons versus last Friday, but with 100% for spot delivery. Soybean stocks at ports increased by 230,000 tons, which improved the crush rate from 51% to 56%, leading to an increase in soybean meal stocks at ports. Additionally, vegetable oils stocks at ports dropped again.

Soybean Paper MKT – April 19

*(daily variation)

May 24 +8sk (-2) vs -5sk (unch)

June 24 +15sn (+5) vs +8sn (+5)

Jul 24 +35sn (unch) vs +25sn (+10)

Aug 24 ?? vs +22sq (+2)

Feb 25 -25sh (unch) vs -45sh (unch)

Mar 25 -45sh (+5) vs -63sh (-3)

Apr 25 ?? vs -68sk (unch)

May 25 ?? vs -60sk (unch)

Jun 25 ?? vs -55sn (unch)

Jul 25 ?? vs -50sn (unch)

Trades (Fob Paranaguá): no trades

Cargo Market (Santos)

FH Feb25 ?? vs -35sh (unch)

FH Mar25 ?? vs -55sh (unch)

To start your free trial please click here