PSF: 05_05_2025

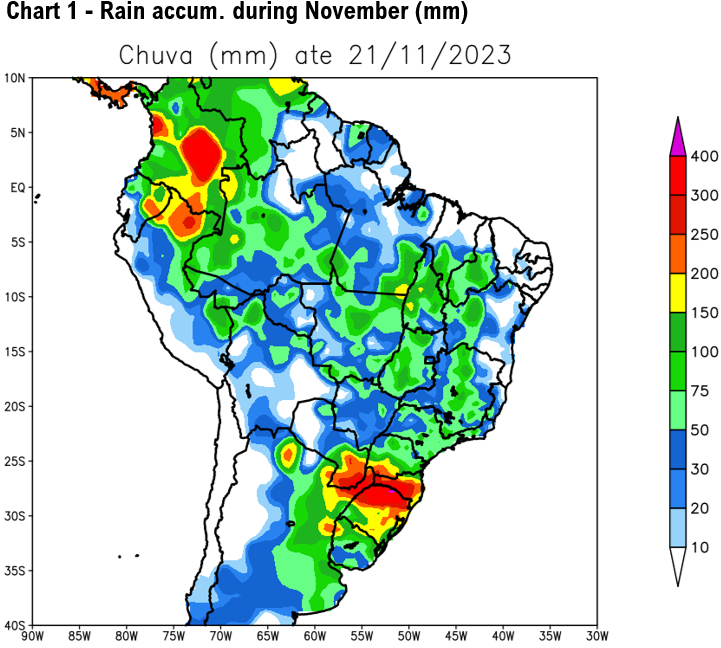

Weather: NOAA has changed its El Niño projection again. Water temperatures at 3.4 region are not expected to rise much further and should start to drop in December. A few days ago, NOAA showed that the temperature anomaly would remain high until the end of January. The temperature of the waters in region 1+2 should also drop. The AAO index should remain in its negative phase for another 14 days, associated with the neutral phase of the Madden-Julian. I'm not meteorologist, but the guys of Refinitiv said that all of this is favorable for more rains in the Amazon region. Therefore, there was a change in the rainfall anomaly pattern for December. In the latest anomaly map, meteorologists projected normal rainfall volumes for the central region of Brazil and above normal for Parana state, the 3rd largest (21 million tons of soybean – Conab estimate). Producers of WhatsAPP groups that I participate in, still say that there will be crop failure in Mato Grosso and other Northern states, but they recognize that conditions have improved. Overall, trading companies have an average estimate of 159.5 million tons and consultancies have an average of 158.5 million. It is still a large crop – the average estimate in October was at 163 million. Unlike the 2021/22 season, the crop failure this year should be more concentrated in Brazil. In that season, the crop failure in South America affected the south of Brazil, Paraguay and Argentina. In the WASDE of May 2021, USDA projected a combined crop size for Argentina, Brazil and Paraguay at 206.5 million tons. In December 2021 USDA estimated 187.5 million, and in May 2022 USDA has cut its estimate to 171.2 million, a drop of 17%.

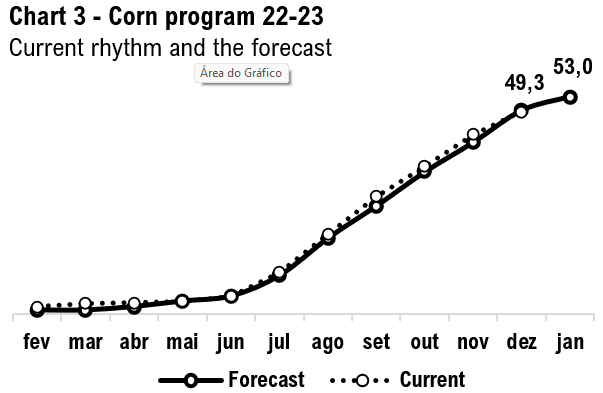

Corn Market: This week the Taiwanese MFIG booked corn via tender, confirming that corn from Brazil is out of the game. The Taiwanese company purchased 65 thousand tons of corn for shipment Jan-Feb at 157 cents per bushel over the March CFR. With shipping cost at 68 cents per bushel, this corn would have traded below 90 cents on the Fob Santos. Offers from Brazil to Taiwan would be around +171h – replacement CFR Taiwan based on trade level Fob Santos for Dec-Jan. South Korea also purchased corn. The price was +174.4h CFR Korea. The trading companies said it was from Brazil. With ocean freight at 94 cents per bushel, it would correspond to a Fob premium of +80h, at least 20 cents below current levels, which confirms that Brazil is no longer competitive. This week Agrinvest brokers reported trades in Goias and Paraná. The origination cost varied between +130h to +145h, therefore well above the levels that the international market is paying. That's why we're already seeing a sharp drop in the pace of corn nominations. So far, Brazil has shipped 41.7 million tons of corn and there are 2.4 million named for this month and 5.6 million for December. If the total nominations are shipped in time, we will reach the end of December with 49.7 million tons. In this scenario, which the replacement cost is way above the CFR levels, I don't believe in more than 3 million tons of exports for January. From a potential export program of 58 million tons, I would say we may see 53 million tons. We will have a larger ending stock, which would help the domestic market in the case of smaller safrinha next year. In Mato Grosso, after a long time away from the spot market, ethanol plants returned to purchasing for January shipment, bidding way above the Fob levels. It makes sense if you look at farmer selling for the safrinha 2024 just under 10% in Mato Grosso, when normal level for the state would be at least 35% in other years.