PSF: 05_05_2025

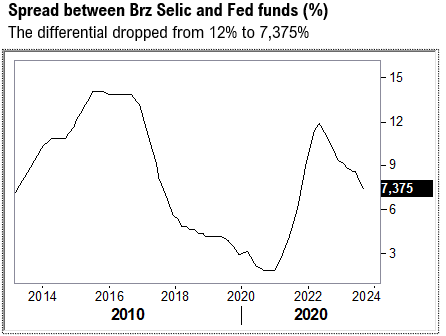

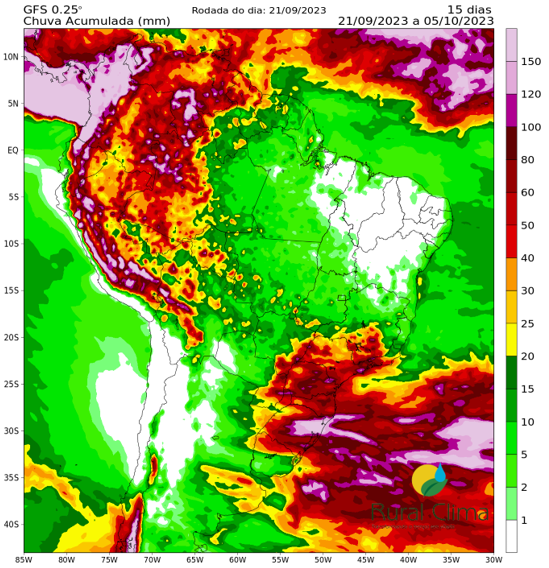

Brz Markets - Recap: Fed Higher for Longer and Brz CB on the opposite direction. BCB cut interest rate by 50 bpts yesterday to 12,75% and hired more 50 bpts cut for the next meeting in November. The spread between Brz Selic and Fed funds nominal rates dropped from 12 percent points in May 2022 to 7,375 ppts – by the end of the year, the differential will drop to 6,625 ppts. Let´s see how FX in Brz is going to work today how farmer selling will evolve. Most part of the farmers in Brazil have inputs bills coming due at the end of this month, which may increase farmer selling and fixings. Farmer selling of corn and beans remains sluggish due to prices downward in the last few days. For beans, flat price in the interior fell by 40 cents per bushel since the WASDE report. Another factor is the very dry and hot weather. GFS keeps showing minimal rains for the next 15 days for most part of Mato Grosso and Goias.

Soybean Paper MKT close 20 Sep

Feb -55sh vs -65sh

Mar -95sh vs -110sh

April -90sk vs -105sk

AM -85sk vs -100sk

May -75sk vs -95sk

June -75sn vs -85sn

JJ -70sn vs -80sn

July -60sn vs -75sn

Cargo Market – Santos/Tub

FH May -70sk vs ??

FH June -50sn vs ??

Trades reports: No trades reports.

Brazilian weather: GFS keeps showing minimal rains for the next 15 days for most part of Mato Grosso and Goias. Parana is the most advanced state in planting progress, with 6% till last Friday. Mato Grosso should be the most advanced, but the weather is not helping. For now, there is not a great concern yet, but if the 1H half of October remains hot and dry for the center of Brazil, then the prices have to move, futures and premiums, pricing slow planting progress, smaller Jan and Feb export program and higher risk for safrinha corn supply for 2024 – farmers in the North will plant corn out of the best window. Maps show temperatures between 38 °C and 42 °C throughout the Center West (100-108 F), Southeast and South, except for Rio Grande do Sul for the next 15 days. Air humidity in the Center West will drop to less than 10% in the coming days. I hear that there are producers planting in the west, along the 163 Highway and in the South of Mato Grosso, confident in soil moisture in regions that received accumulated rainfall exceeding 100 mm in recent days and in forecasts for next week, which is a very dangerous game. Replanting is an unaffordable risk this year. There are already few reports of fertilizer contracts cancelations, due to credit risk.

CFR China Round up: No traders reports

Soybeans CFR China (Brazil)

Oct +250/245sx vs ??

Nov +245/240sx vs +225sx

Dec +228/225sf vs +215sf

Feb 24 +90sh vs +70sh

Mar 24 +35/30sh vs ??

Apr 24 +23/20/18sk vs ??

May 24 +31/25sk vs ??

Jun 24 +48sk vs ??

Jul 24 +68sk vs ??

Aug 24 ?? vs ??

Soybeans CFR China (USG)

Oct +265/258sx vs ??

Nov +250/245sx vs ??

Dec +222sf vs ??

Jan +228sf vs ??

Soybeans CFR China (PNW)

Oct +260sx vs ??

Nov +255/250sx vs ??

Soybeans CFR China (ARG)

Oct around +205sx vs ??