Panorama Semanal dos Fertilizantes

Morning Wrap up – Soybean and corn premiums are under pressure

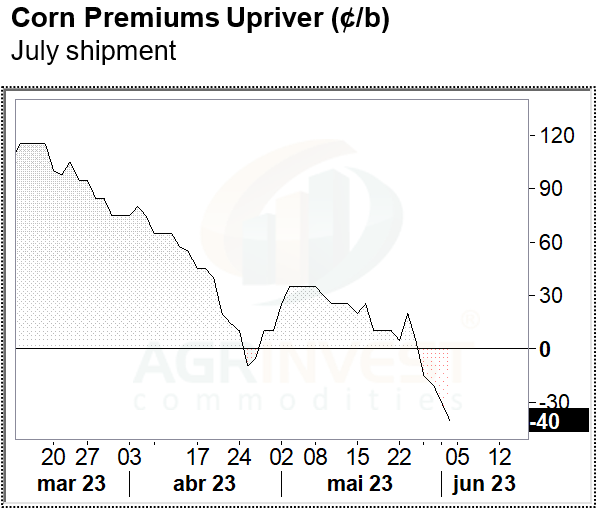

Brz Soybean and corn Markets - recap: Premiums for corn and beans in Brazil will end the week with strong loses. For corn, the drop till Thursday was 25 cents per bushel for July shipments. In Argentina trades reported at -40n on Upriver, which is equivalent to -15n for a cargo in Santos. The drop is due to selling pressure from Argentina and lower origination costs in Brazil – replacement cost FOB. Futures rallied, but prices in BRL per sack did not change much – basis in the interior fell. This is mainly due to the lack of space and rush for logistics – many farmers are still trying to sell for June shipment. The replacement cost for corn is around -20/-25n FOB. This means that there is margin in origination.

Offers for August Santos at +30u on Friday – it was +45u the week prior.

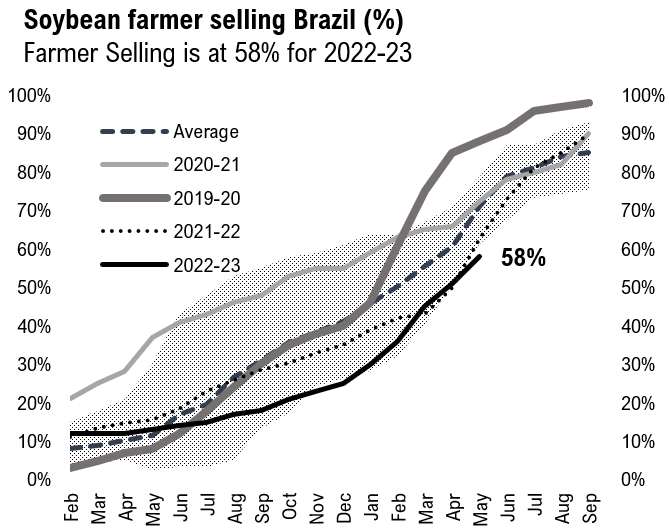

For soybeans it is the same story. Futures climbed, but the flat price in BRL per sack didn´t changed much. The result was lower basis in the interior. Allied to this, truck freight fell for some routes – this is a good gauge about ports inefficiency. Putting it all together, the fundamentals on the CFR basis fell sharply last week (see below). In the week, the July sb premium accumulates a drop of 60 cents per bushel in FOB.

Farmer selling of soybean LW was 2.2 Mi tons (4 days) and 1.5 Mi tons of corn. For soybean FS is 58% and 37% for safrinha corn.

Brz Crush: Abiove estimate crush Jan-Mar in 12.1 Mi tons. According to lineups, sbmeal export for April and May totaled 3.84 Mi tons, which is equivalent to 9.6 Mi tons of crush. In this case, crush during Jan till end of May would be 21.7 Mi tons vs 20.86 Mi tons LY – Abiove estimate a growth of 2.1 Mi tons Jan-Dec.

CFR China: Trades reported for July at +27n/30n/33n/38n/40n/45n. Trades got rhythm during the afternoon of the last Thursday till Friday´s morning, with levels going down gradually (Brazil time). The falling of the levels traded on CFR followed the lower origination levels in Brz.

Trades reported for Aug at +45n/48n/49n and for March at +75h – new low for NC. Traders estimate 18-20 cargoes traded last week.

Soybeans CFR China (Brazil)

July 40n vs 30n

August 55/48n vs 40n

Feb 24 118h vs ??

Mar 24 85/80h vs 75h

Apr 24 75k vs ??

Soybeans CFR China (USG)

Oct 238x vs

Nov 237x vs

Dec 230x vs

Soybeans CFR China (PNW)

Oct 257x vs

Nov 240x vs