Panorama Semanal dos Fertilizantes

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 22/11/2024 08:39

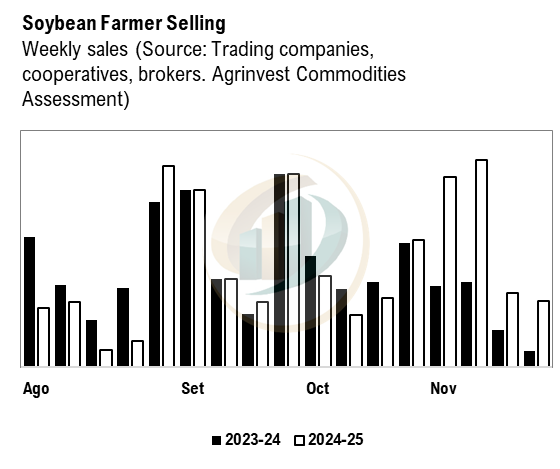

More trades reported CFR China this week. Sino booked a few more US cargoes for Feb. Estimates of 30-35 soybean cargoes traded this week CFR China. Freights for nearby plunged, making the USG competitive. Besides that, Brz sold a few cargoes for Dec and Jan-Feb this week. China still has to cover 5-6 Mi tons for Dec-Jan – others say could be much smaller. Soybean farmer selling in Brazil has been much smaller than at the beginning of the month. Last week the total FS was 900k tons and this week will close even lower–Soybean premiums Fob Paguá rebounded from the week’s lows (April traded at +17sk on Tuesday and at +30/35sk ystd). Flat price in the interior of Brazil dropped 4-6 BRL per sack. Corn farmer selling for the 2025 safrinha is more active. Reports of increasing urea purchases in Mato Grosso and Goiás. Rumors of corn traded CFR China (no details). CSI300 sank today (3.1%). A growing worry in the potential trade war with the US. A declaration of Chinese foreign ministry shows how China would manage this escalation - consumers will have be bear the costs (US consumers). Maps are showing a reduction of rains for the next 15 days for MGDS, São Paulo and Paraná (20-30% of the normal). For MT, GO and the rest of the Northern states the accumulated rainfall will remain above normal volumes.