PSF: 16_02_2026

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 26/03/2024 08:43

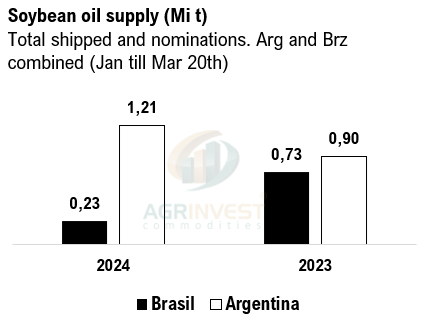

The Soybean CFR market is currently in a holding pattern, with trades appearing to slow down significantly. Recent soybean auctions and the deterioration of the crush margin have further contributed to this. Sales of soybean meal have seen a drop in momentum over the last three days. A significant portion of March sales were focused on the spot market, accounting for 56%. Brokers in China believe the restocking phase may have ended. Additionally, feed mills are expressing concerns about the high costs paid previously, which has led to decreased interest in further purchases. Looking ahead, a new soybean auction is on the calendar for this Friday, with 219,000 tons – 650,000 tons of auctions so far. A Bloomberg article from last week highlighted the government's exploration of strategies to encourage the use of local beans for crushing. In Brazil, soybean premiums are aligning with the lower values observed in the CFR market, especially for May and June shipments. Crushers in China are 100% covered for April and about 50% for May. There are speculations that Chinese crushers may have overextended their coverage for March and April, considering the soybeans currently in transit. This situation could potentially reduce their procurement needs for June and July. Soybean oil flat price in Argentina and Brazil is strengthening. This trend is closely linked to the positive fundamentals of Palm Oil market and the lower export commitments from both Argentina and Brazil. Additionally, biodiesel production in Brazil is surpassing the mandatory requirements – biodiesel price in Brazil is currently cheaper than diesel.

Soybean Paper MKT – March 25

*(daily variation)

May -15sk (-5) vs -27sk (-2)

June -7sn (-1) vs -13sn (unch)

Jul +20sn vs -3sn (-6)

Aug +30sq (unch) vs ??

Feb25 -25sh (unch) vs -45sh (unch)

Mar25 -50sh (-5) vs -68sh (+2)

Apr25 -45sk vs -72sk (+3)

May25 -35sk vs -65sk (unch)