Áudio com informações do abertura do dia no agronegócio

Por: Eduardo Vanin

Artigo, Grãos

Publicado em: 23/02/2024 08:53

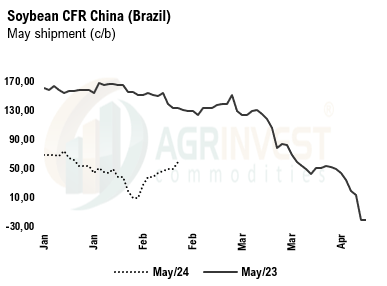

The flat prices for soybean and corn at Brazilian FOB ports are on a downward trend, exacerbating the challenges of origination and compressing margins further. There were rumors of additional soybean trades to the US yesterday – the calculation seems good. As expected, the Argentine government has decided to abandon the planned increase the biodiesel blend requirement. In Brazil, the crushing margin is feeling the squeeze, prompting facilities in Paraná to opt for Paraguayan soybeans over local ones. The corn market in Brazil remains stagnant. The export sector is increasingly focusing its efforts on redirecting second-crop (Safrinha) corn to meet domestic demand. This strategic shift is influenced by the cost dynamics, with origination priced around +120CN and FOB levels for Santos at +48cu. The decline in corn's flat price is bolstering margins for the poultry and pork industries, enabling them to offer slightly above export parity for the August/September period – however, the coverage remains very short. Meanwhile, bids for Safrinha corn on the FOB are vanishing, leading to a generally softer market tone, even in the absence of significant farmer selling. Sellers at Fob are reducing their asking prices but are unable to find firm buying interest.

Soybean Paper MKT – Feb 22

March -70sh vs -80sh

Apr -60sk vs -65sk

May -45sk vs -55sk

Jun -20sn vs -40sn

Jul -5sn vs -25sn

Feb25 -15sh vs -28sh

Mar25 -45sh vs -58sh

Apr25 ?? vs -80sk

May25 ?? vs -70sk