PSF: 05_05_2025

Brz Markets - Recap: No trades reported due to national holiday. European model is keeping the forecasts for the next 5 days – more rains up North and new round of excessive rains down the south. Rio Grande do Sul may have 2.5 million tons of feed wheat, way above the normal. Trades reported at $212 per ton Fob Rio Grande port for Dec, adding pressure over corn premiums – indications for corn Fob Santos at $225 per ton for Dec. Rumors of corn trades Fob PNW for Jan at +100h. At this level, US corn is cheaper than Brz CFR Asia. Still trying to check the number of soybean cargoes sold to Sino this week out of the USG – Feb shipment (last trade at +185h).

Soybean Paper MKT – Nov 1st

Feb -55sh vs -70sh

Mar -90sh vs -100sh

April -90sk vs -115sk

May -75sk vs -100sk

JJ -60sn vs -80sn

Jul ?? vs -65sn

Trades reports: no trades.

Cargo Market (Santos/Tuba)

FH Apr -70sk vs ??

25apr – 10may -60sk vs ??

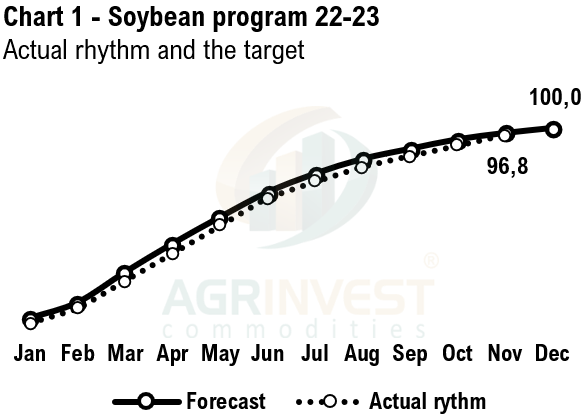

Brz corn and soybean programs: The Brz corn and soybean export programs are very strong. Soybean export program for 2022-23 could exceed 100 million tons (Jan-Dec). As of the end of October, the total shipped volume was 91.3 million tons. Nominations for November are at 5.7 million tons. The Brazilian program is already at 97 million tons (exports and nominations combined). The volume for December is still very uncertain. China is still very open for December and January shipments – analysts and traders are cutting the estimates. Brazil is offering CFR China cheaper than the US, but it's not a large volume. There is demand and Brazil is competitive. A potential barrier for December program is the lack of elevation capacity. Where there is soybean to export, there is no elevation, and where there is elevation, there is no soybean available. Rio Grande port has a very low lineup, close to 1 million tons of soybean, but it is becoming increasingly difficult to originate and transport soybeans to this port due to expensive truck freights. Santos port is committed to corn. Aratu will continue to serve the soybean program, but there is not much supply in Bahia state, and it is expensive. Paranaguá already has 3 million tons of soybeans in its lineup, shipments that are already causing many extension problems, in addition to growing inefficiency – the most likely reason for WO´s heard last week. The size of the Brazilian program is a very important topic because it will tell us what the size of the 2024 program will be. If Brazil's soybean production for the new crop is equal to or greater than this year’s, together with the growth in export capacity and a reduction in the corn program, we will have a favorable scenario for a program of 105-110 million tons, a very negative scenario for US demand.

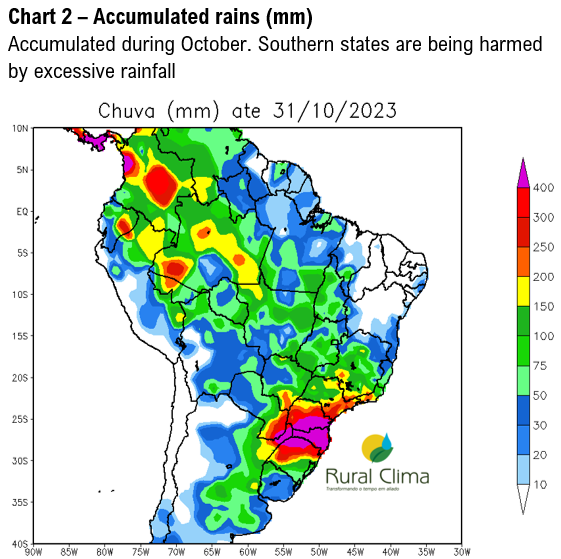

The Brazilian corn program is advancing very quickly. The total shipped volume reached 36.4 million tons and the total volume of corn nominated for export is 9 million. Adding up the numbers, the BRZ corn program reached 45.4 million tons, still in line with a program of at least 55 million tons. As expected, the total nominations at Northern ports are falling (Barcarena, Itaco, Itaqui, Santarem and Santana), which is more than compensated for by strong growth in Santos. Since the beginning of the month, total nominations at Northern ports fell by 600,000 tons. In Santos, total nominations grew by 780,000 tons. It seems that Santos is getting the job done, keeping the corn program at a good pace. Depending on logistics and the competitiveness of Brazilian corn, it would not be difficult to build a program closer to 60 million tons by the end of January. On that last point, some new trends are starting to appear on the horizon: 1) corn premiums Fob PNW are falling, thanks to railroad rate discounts. Trades reported this week at +100h for January shipment (Fob). At this level, American corn is cheaper than Brazilian corn CFR Asia; 2) Asia is replacing corn with feed wheat. Brazil will have at least 2.5 million tons of feed wheat to sell, wheat produced in Rio Grande do Sul, state which is being harmed by excessive rainfall. Brazil has already sold 5 cargoes to Vietnam and 2 to Philippines. All of this puts pressure on corn premiums, which makes the origination margin even more negative.

CFR China Round up: No trades

Soybeans CFR China (Brazil)

Nov +215sf vs ??

Dec +215/208/200sf vs around +190sf

Jan +175sh vs ??

Feb 24 +115/110sh vs +80sh

Mar 24 +45/43sh vs +35sh

Apr 24 +25/20sk vs ??

May 24 +35/30sk vs ??

Jun 24 +45sn vs ??

Jul 24 +65sn vs ??

Soybeans CFR China (USG)

Nov +220sf vs ??

Dec +215sf vs around +190sf

Jan +205sf vs ??

Feb +185sh vs ??

Soybeans CFR China (PNW)

Nov +210/205sf vs ??

Dec +200/195sf vs ??

Soybeans CFR China (ARG)

May +48sk vs ??

Jun +40sn vs ??

Jul +55sn vs ??