PSF: 05_05_2025

Brz Markets - Recap: Soybean Farmer selling this week is being very slow. Premiums for new crop are bit firmer this week. I´d say it´s due to dry weather in Mato Grosso (maps are more friendly today). Crushing margin was better ystd again – still negative in around $14/t. The calculation is close to breakeven if you add up the biodiesel. Soybean meal and oil premiums for October and November were firmer. Soybean meal supply in the domestic market seems tighter, Agrinvest brokers mentioned. More Paraguayan soybean offers FOB Arg ports, which confirms the crushing margin in Arg is ugly, even with the Soy Dollar 4. In the corn market, Agrinvest Brokers mentiond farmers in North are bartering 2024 corn imputs using 2023´s corn. Hearing some switchs from US Gulf to Brazilian northern ports taking places for Central America/Latin America buyers due to logistics. Trades reported Up River at +90z for LH Oct.

Soybean Paper MKT close 14 Sep

Oct +60sx vs +45sx

Feb -55sh vs -80sh

Mar -105sh vs -130sh

April ?? vs -125sk

AM ?? vs -115sk

May ?? vs -110sk

JJ -75sn vs -95sn

Trades reports: No trades reports.

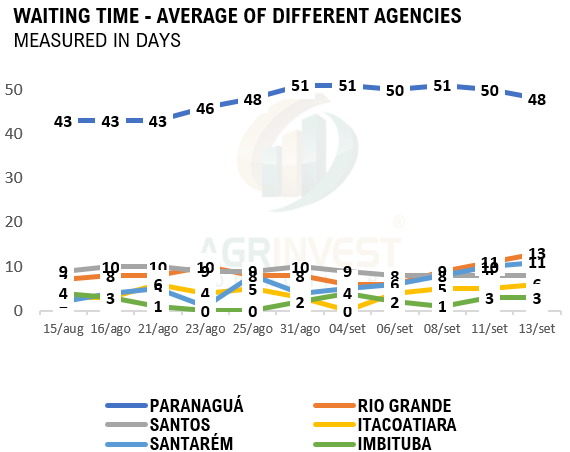

Corn Market: Trades reported out of Up River for FH of October shipment at +90z, very sharp increase in the last two weeks – Brazil usually trades 10 to 15 cents per bushel above Argentina for a Panamax. This trade supports current premiums levels on FOB Brazil at +105z in Arco Norte and +115z in Santos for October shipment. There are other factors that are supporting corn premium levels in Brazil: 1) Premiums in the Gulf remain high; 2) Premiums in Argentina for nearby shipments rose, which confirms that the market continues to work on “hand to mouth” mode – market is very open for November and December; 3) China continues to purchase, asking for offers for nearby shipments in Brz, keeping premiums firm for October and FH of November– the total corn nominations for October are at 3 million tons. I would say there is still room for more sales; 4) the main point is the replacement cost in Brazil. This is the main reason for premiums remain firm. The origination cost in Mato Grosso and Goias is hovering around +120z to +140z FOB Santos, 5 to 15 cents above the current FOB levels. However, even with firmer premiums, the South of Brazil is not feeling this effect. From Mato Grosso do Sul downwards, the scenario is completely different. The port of Paranaguá remains dedicated to soybeans, forcing the flow of corn from these states to more distant ports, putting pressure on local prices. Corn nominations in Paranaguá remain practically unchanged in the last 30 days at 1.2 million tons. The waiting time in Paranaguá fell this week to 48 days and soybean nominations also fell, but the pace is very slow. Till 13 September, soybean nominations were at 3.34 million tons, against a peak of 4.8 million at the end of August. The result is that the corn price in Paraná – 2nd largest safrinha corn producer - is at the same level as the south of Goias close to R$44.0 per bag – never seen this before. The difference is that corn from Goias is being priced by Arco Norte and Santos export parity, and Parana is being priced by Paranagua.

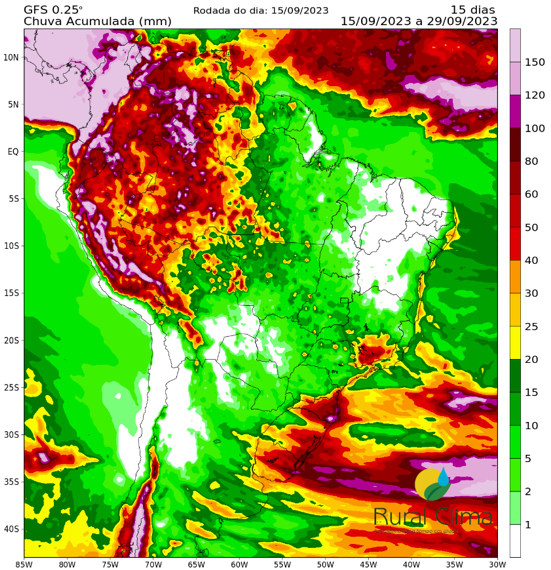

Brazil: Soybean planting is taking place in Mato Grosso, but only in the west of the state – 15% of the state acreage - where it has been raining since the beginning of the month – for cotton market it is bearish. In other regions, I only heard about planting in irrigated fields. The majority are waiting for better conditions and more reliable weather forecasts. The map shows more rains for Northern of Mato Grosso, the main soybean region of the state. It is consensus among farmers we talk regularly, “better to sacrifice corn window at current level of prices”. The major concerned in Mato Grosso is the soybean replanting costs. Today GFS model show more rains for October than the last run. Models are also showing an above-normal rainfall pattern for January and February, which would be bad for quality and harvest speed. For Parana and Paraguay, maps for 15 days are drier and warmer, which is going to be beneficial for planting progress – the soil moisture is ideal for planting at this part of the SAM. The west of Parana may start harvest just after the last half of January.

CFR China Round up: More trades reported out of Arg and Brz. Didn´t see any trade from the US this week

Soybeans CFR China (Brazil)

Sep/Oct ?? vs ?? – trades reported at +240sx

Oct +245/240sx vs +235sx

Nov +240/235sx vs +230sx

Nov/Dec +235sx vs +225sx

Dec +225/220sf vs ??

Feb 24 +90sh vs ??

Mar 24 +33/28sh vs ??

Apr 24 +15/13/11sk vs ??

May 24 +25/23/21sk vs ??

Jun 24 +43/42sk vs ??

Jul 24 +58sk vs ?? – trades reported at +55sn

Aug 24 ?? vs ??

Soybeans CFR China (USG)

Oct +240sx vs +235sx

Nov +240sx vs +230sx

Dec +222sf vs ??

Soybeans CFR China (PNW)

Nov +260sx vs ??

Soybeans CFR China (ARG)

Oct around +205sx vs ?? – Trades at +205sx